If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Introduction

In today’s global marketplace, businesses of every size are looking for the best business accounts that can adapt to their unique operational demands. Opening a business account with Fondy provides companies with the essential financial infrastructure needed to conduct transactions seamlessly across borders. Whether you’re a startup looking to get your first business bank account or an established enterprise aiming to expand your banking capabilities, Fondy offers specialized solutions designed to help businesses get ahead in a competitive landscape.

The process to open business accounts with Fondy is streamlined and efficient, allowing entrepreneurs to focus on what matters most — growing their business. With dedicated IBANs and the ability to manage multiple currencies, your business can start accepting payments from customers abroad without complicated banking procedures. Many traditional bank options make it challenging for businesses to get the international banking services they need, but Fondy’s approach removes these barriers.

As businesses expand, their banking requirements become more complex. That’s why Fondy has developed flexible account structures that allow companies to open and operate multiple business accounts based on their specific needs. Whether you need a standard bank account for basic business operations or a master account with advanced features, Fondy’s platform helps businesses get organized with their financial management while maintaining full visibility and control over their funds.

Table of contents

- How to open business accounts – Create standard or master business accounts with dedicated IBANs, set up sub-accounts, and organize your banking structure.

- How to make global payments – Send funds to external counterparties or transfer between your own accounts seamlessly.

Let’s dive into the details of getting your business banking infrastructure set up with Fondy and start optimizing your payment operations.

How to open business accounts

Setting up business accounts is the first step to managing transactions efficiently on the Fondy platform. Whether you are a small business, a large corporation, or an entrepreneur, having a dedicated payment account allows you to send and receive funds seamlessly. This guide will walk you through the process of creating a new Fondy payment account, selecting the right type, and funding it for future transactions.

Creating a business account

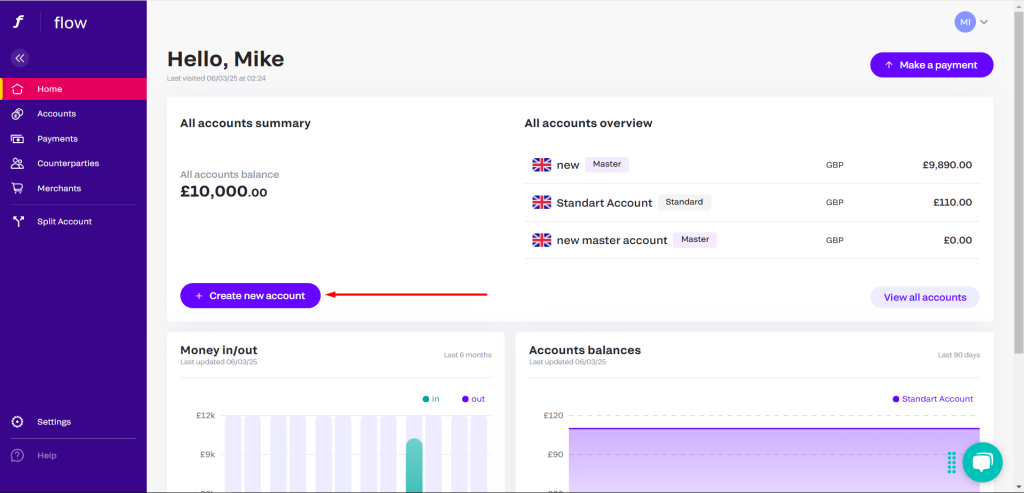

To create a new Fondy payment account, click the “Create new account” button on the homepage.

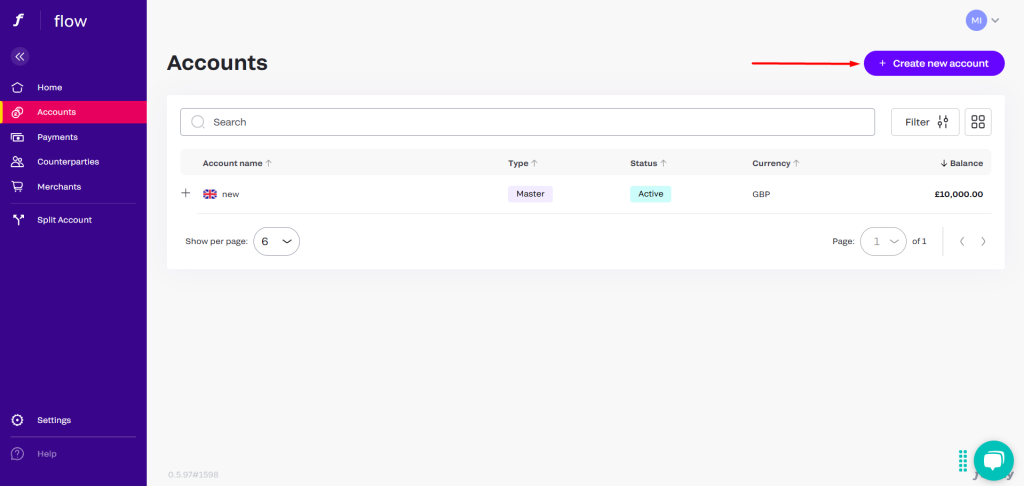

Alternatively, you can go to the “Accounts” tab and use the button there.

Choosing the type of business account

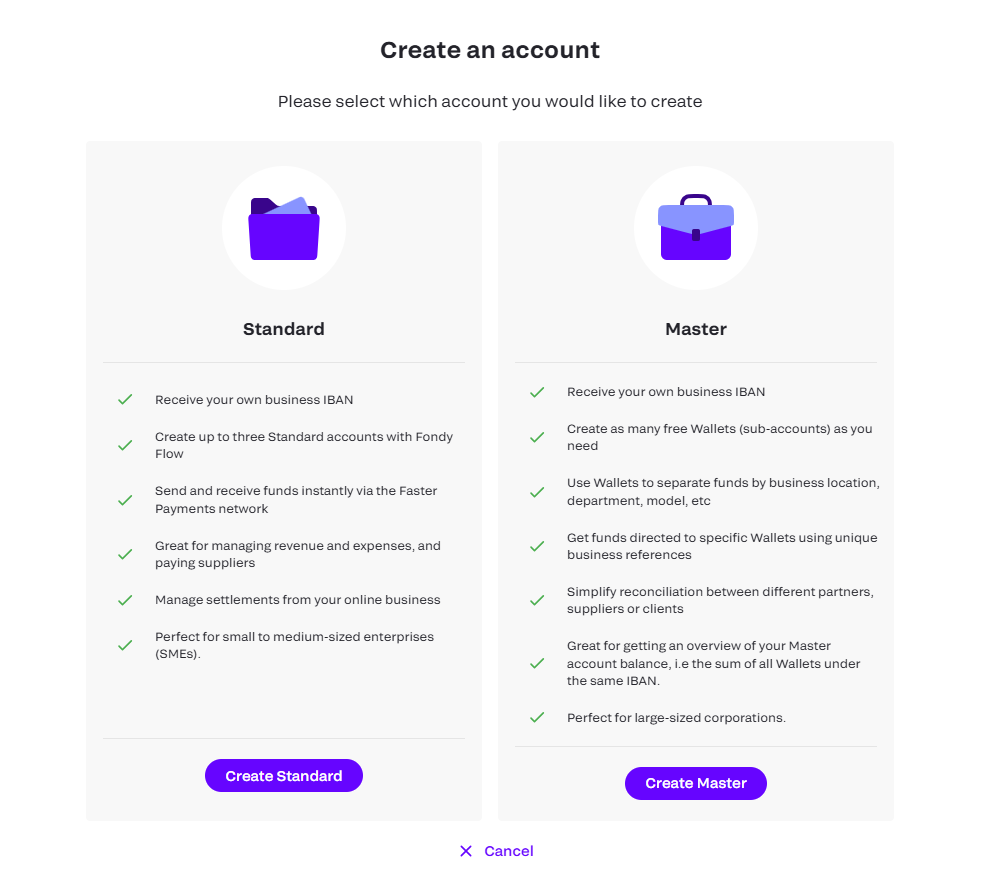

In the next menu, select the type of account you need to create: Standard or Master account.

In both cases, you will receive a dedicated business IBAN. The detailed properties of each account type are described when selecting an option, but in short:

- Master Account allows you to create multiple sub-wallets for free, depending on your business model or location. You can receive funds into these sub-wallets and distribute them to separate wallets for your counterparties. This significantly simplifies fund management, as you will have access to an aggregated balance of all sub-wallets under the same IBAN at the main account level. It is ideal for businesses with complex financial operations or large corporations.

- Standard Account is limited to the creation of up to three standard accounts and does not support sub-account functionality. This type of account is best suited for small and medium-sized businesses.

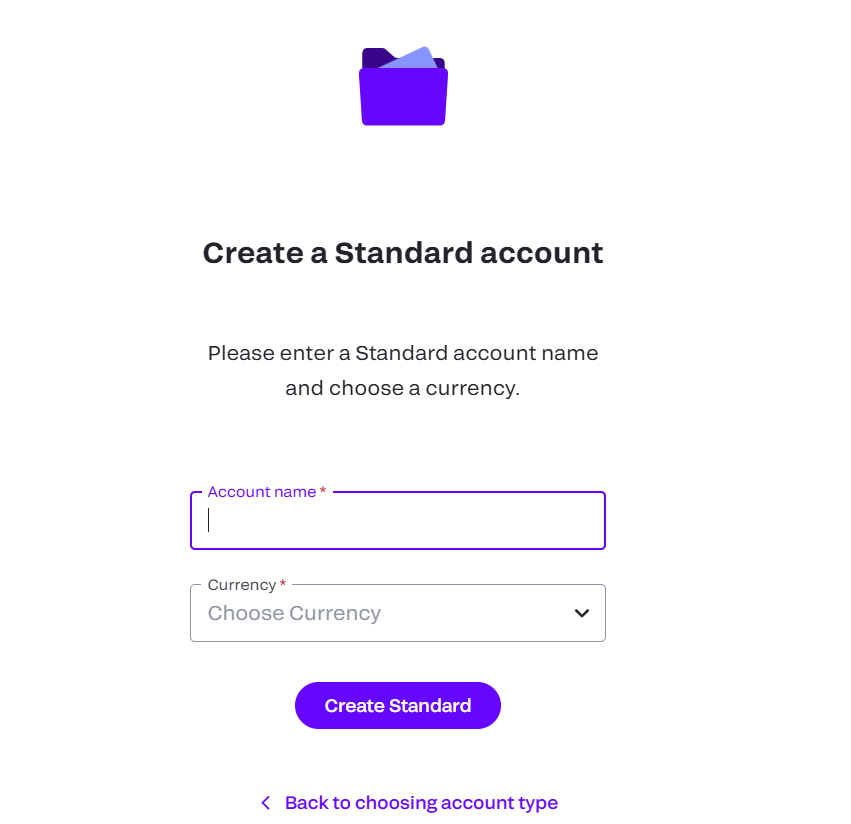

Creating a Standard business account

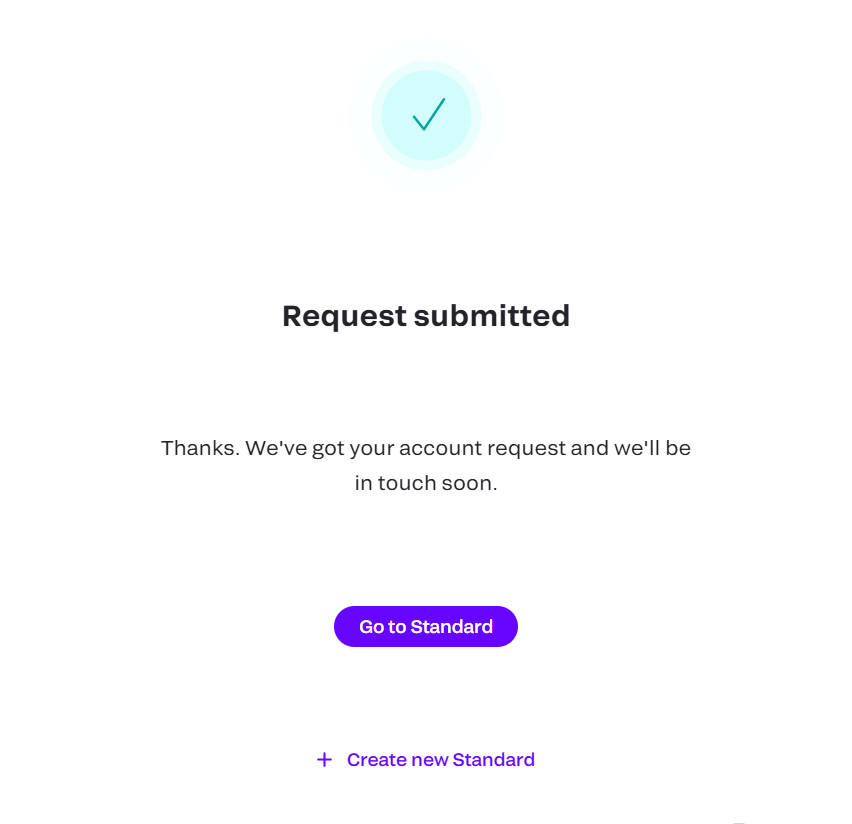

As an example, let’s create a Standard account. Click the “Create Standard” button, then enter the account name and select the currency (GBP or EUR).

After entering the details, you will see a notification confirming that your account creation request has been received. Click “Go to Standard” to proceed.

Managing your business account and funding it

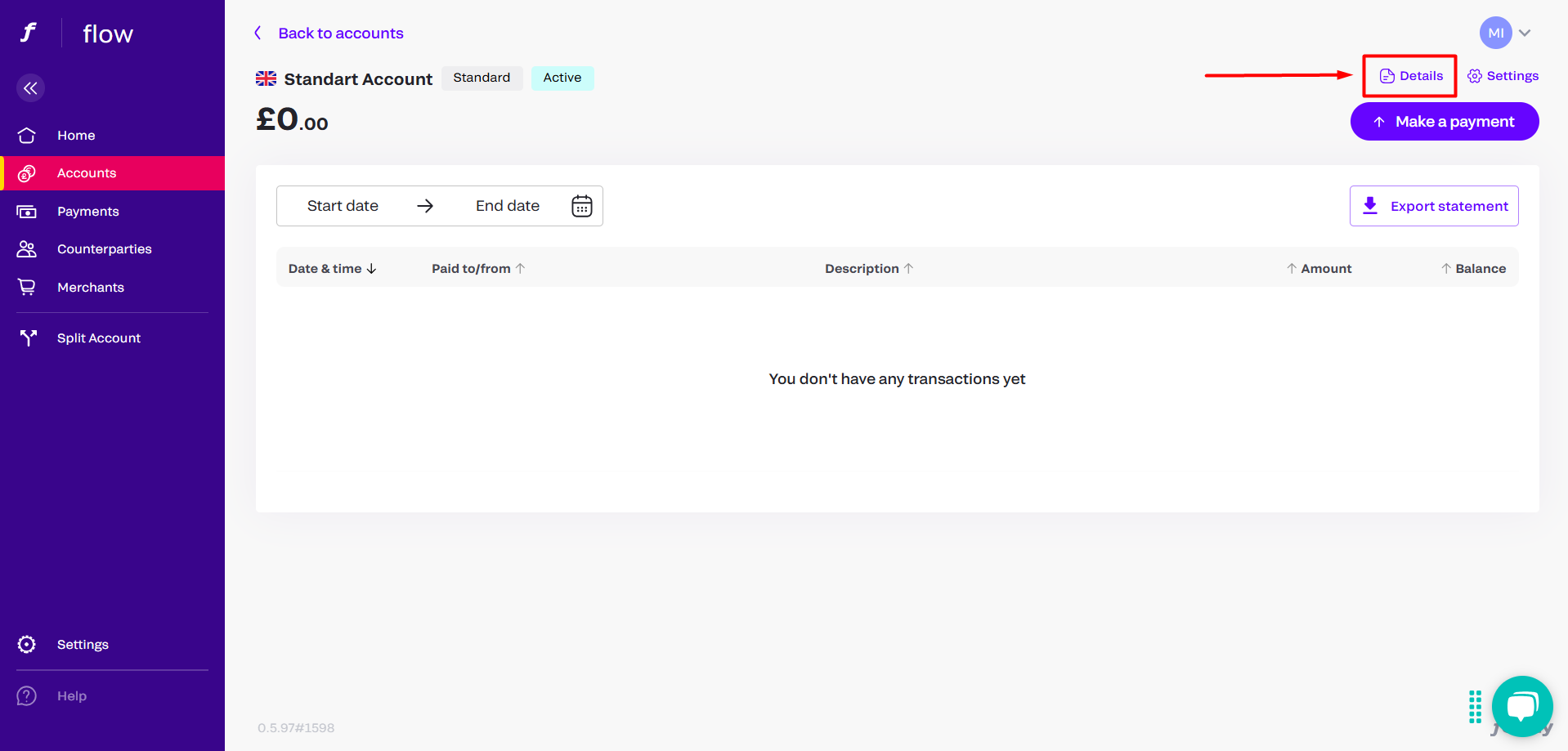

After entering the account management menu, you must fund your account before making payments. If this is your first time creating an account and none of your wallets have funds, you will need to obtain deposit details.

To retrieve your account details, click “Details” in the upper right corner of the screen.

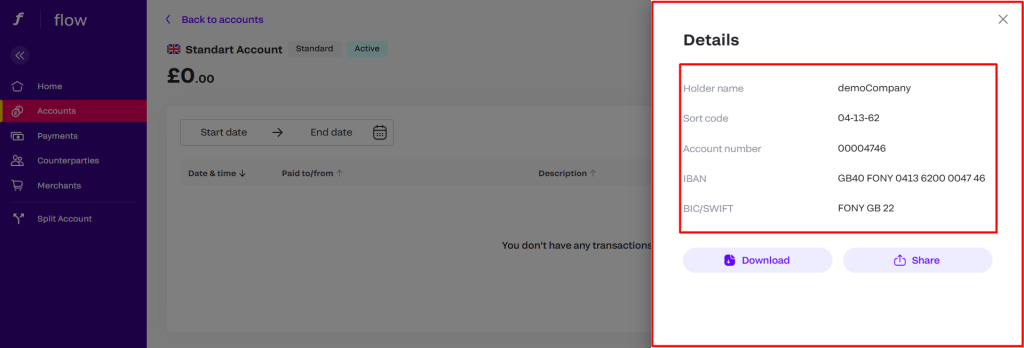

You will receive the following information:

- Holder name

- Sort code

- Account number

- IBAN

- BIC/SWIFT

You can copy individual fields or use the “Download” or “Share” buttons for convenience.

Once you have funded your account, you will be able to make payments. A detailed guide on how to make payments can be found in this article below.

Optimizing your business banking strategy with Fondy

While traditional bank institutions often impose limitations on businesses operating internationally, Fondy’s business accounts are specifically designed to support global commerce. When you open an account with Fondy, you’re not just getting a standard bank account — you’re gaining access to a comprehensive financial ecosystem that understands the unique challenges businesses face when sending or receiving payments abroad.

Many businesses struggle with fragmented banking relationships across different countries, creating unnecessary complexity and administrative burden. With a Fondy business account, you can consolidate your banking operations under one roof while maintaining the flexibility to separate funds as needed. This approach allows businesses to get more visibility into their financial flows and simplifies reconciliation processes that typically consume valuable time and resources.

Security remains a top priority for any business looking to open new banking relationships. Fondy implements robust security measures to protect your business transactions and account information. Each business account benefits from advanced monitoring systems that help detect suspicious activities, allowing you to focus on running your business with confidence. When you open an account with Fondy, you get peace of mind knowing your business finances are protected by industry-leading security protocols.

For businesses with multiple departments or those managing funds for different projects, Fondy’s sub-account feature provides an elegant solution. Rather than having to open separate bank accounts for each business unit (each with its own fees and administrative requirements) you can create dedicated wallets under your master account. This structure gives businesses the separation they need without the headache of managing multiple bank relationships, allowing you to start organizing your finances more efficiently.

Creating a Master business account

If you wish to create a master account, the process is similar to the standard one. You also need to name the account and choose a currency. However, in a master account, you have the ability to create an unlimited number of wallets.

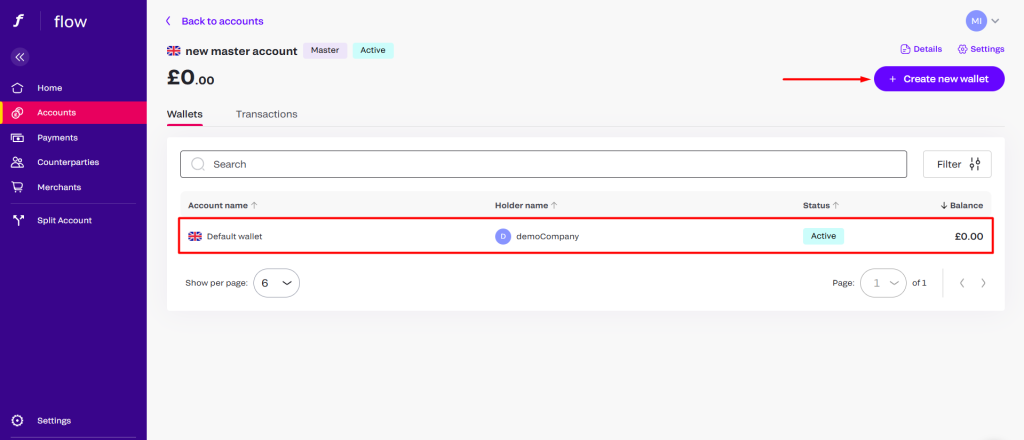

By default, you start with one wallet, but you can create new ones by clicking the “Create new wallet” button.

If you wish to create a master account, the process is similar to the standard one. You also need to name the account and choose a currency. However, in a master account, you have the ability to create an unlimited number of wallets.

By default, you start with one wallet, but you can create new ones by clicking the “Create new wallet” button.

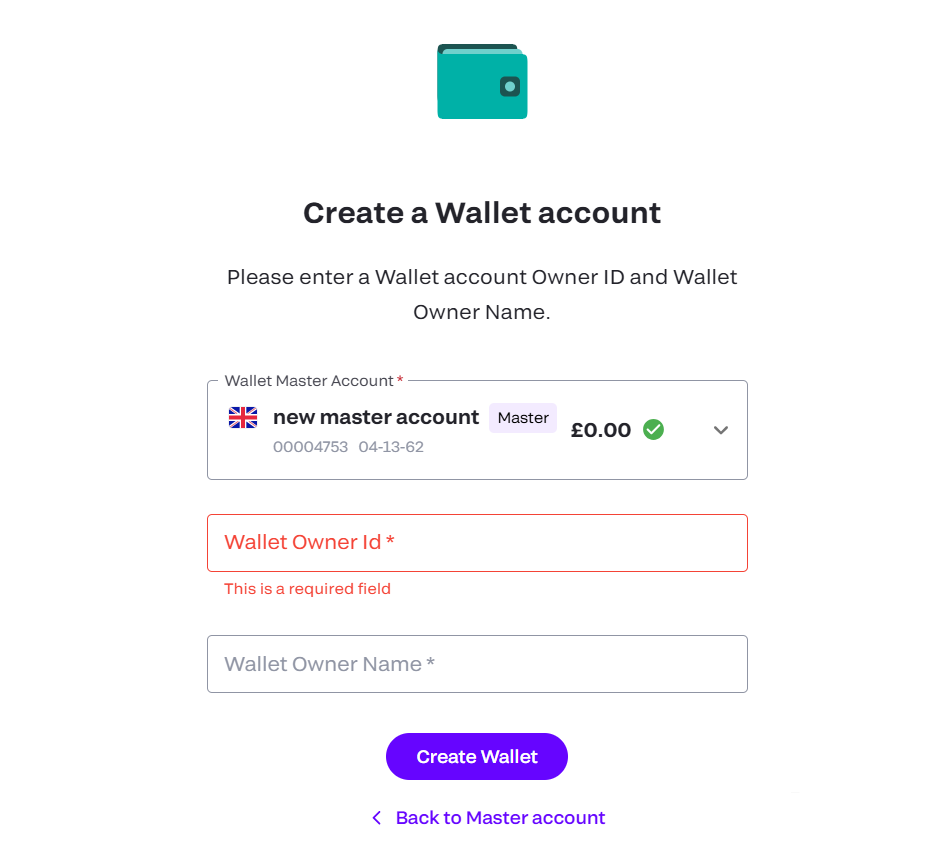

In the next window, the master account under which you are creating the wallet will be displayed at the top. If you have multiple master accounts, you can change it if needed.

You need to fill in two fields:

- Wallet owner ID

- Wallet owner name

Enter any values in the “Wallet owner ID” and “Wallet owner name” fields that will help you identify the wallet (e.g., “PayOut Wallet” / “WalletID 1”, “PayIn Wallet” / “WalletID 15”, etc.). These values will be displayed in the client user interface and included in the account data export files.

How to create sub-accounts

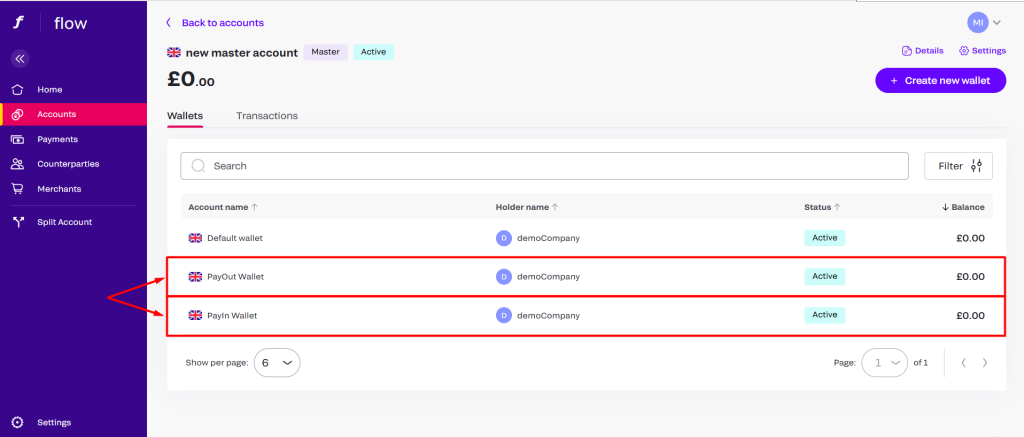

After we have entered the required values and clicked the “Create wallet” button, we have created new wallets that are immediately displayed in the dashboard in the “Active” status column, so you can use them right away according to your business needs.

How to make global payments

Managing payments is simple and efficient. This guide will walk you through the process of making a payment, whether you’re sending funds to an external counterparty or transferring between your own accounts.

Creating a payment

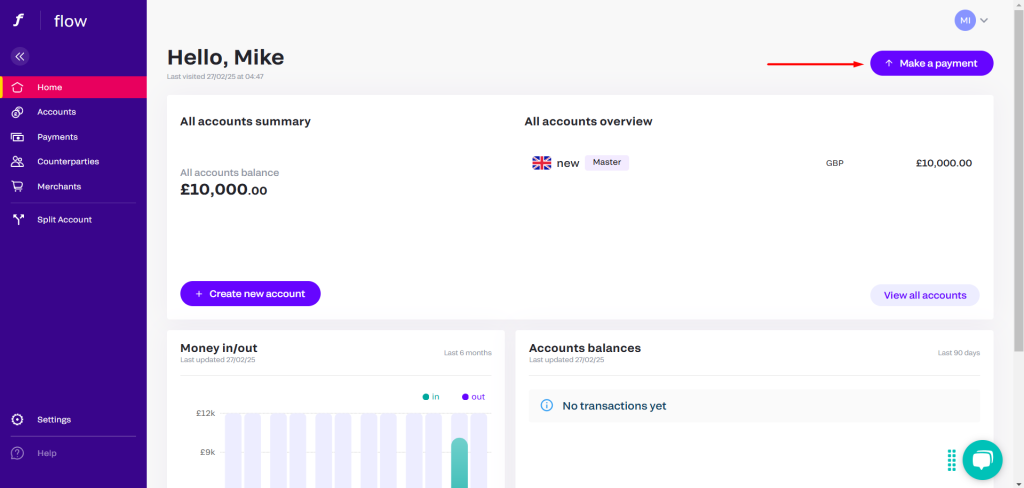

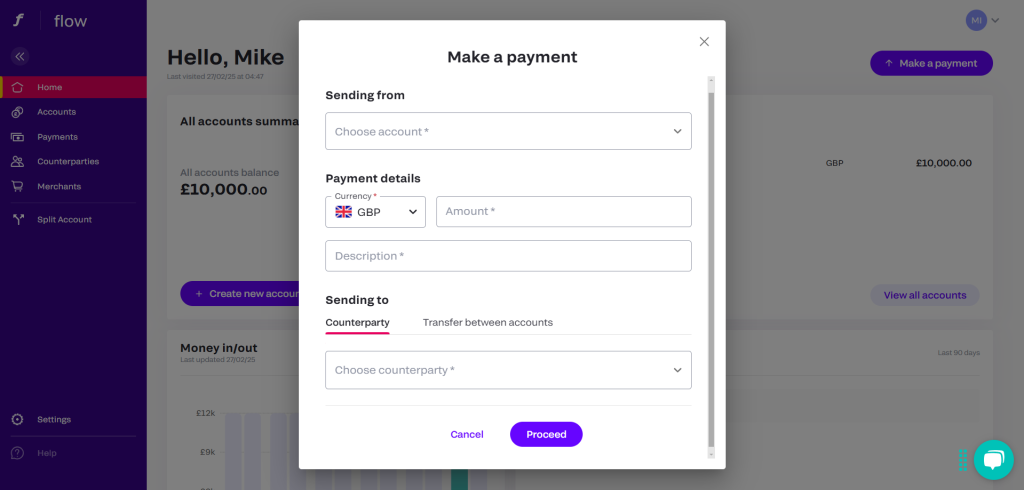

After creating an account and funding the balance, you can make payments. To initiate a payment, click the “Make a payment” button in the top right corner of the screen.

In the dropdown window, a menu will appear where you need to fill in the following fields:

Sending from – In this field, select the wallet from which you want to send the payment (if you have multiple wallets).

Payment details

- Currency – Choose the desired currency from the available options: USD, EUR, GBP, and enter the amount.

- Description – Enter the purpose of the payment.

Sending to – In this section, select the recipient of the payment from next options:

1) Counterparty – Sending a payment to an external recipient.

- Counterparty – Sending a payment to an external recipient.

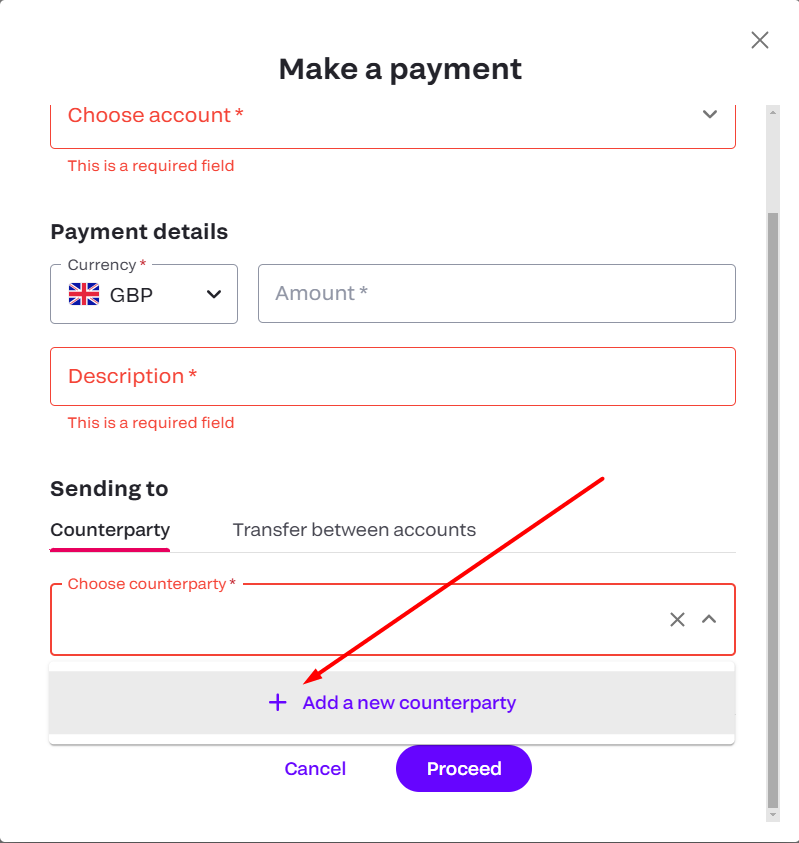

If you are entering the counterparty’s details for the first time, you can immediately fill in all the necessary information in this menu. Simply start typing, and the “Add a new counterparty” button will appear.

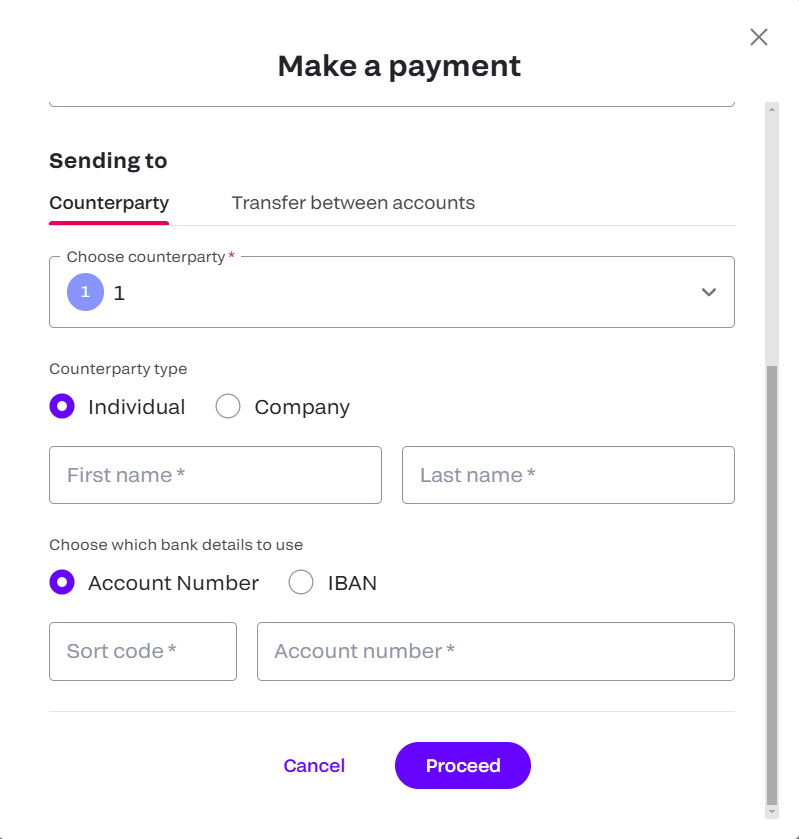

After clicking the button, fill in the following fields:

- Counterparty type – Individual or Company.

- Choose which bank details to use – Account number or IBAN.

- Proceed – click to continue.

2) Transfer between accounts – Select this option if you want to make a payment between your own wallets. In the dropdown list, choose the desired wallet, then click “Proceed”.

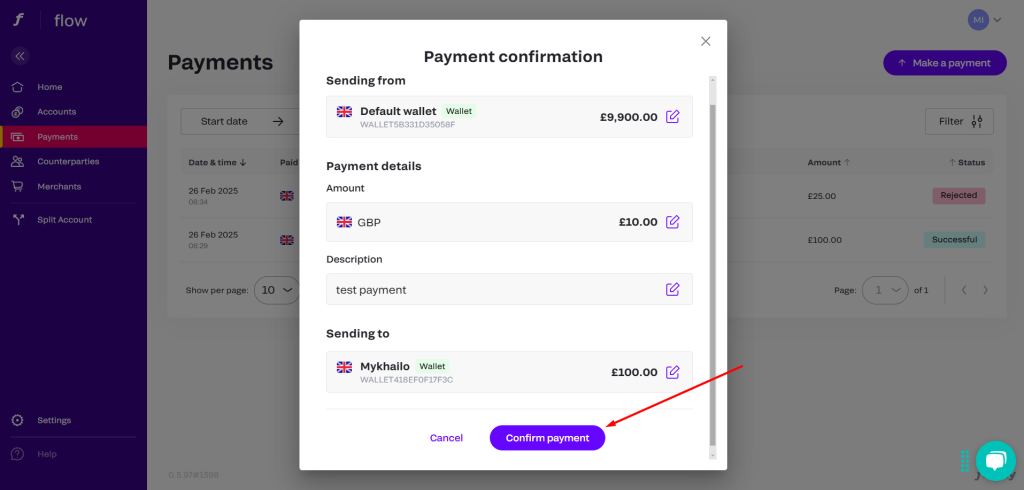

Finalizing the payment

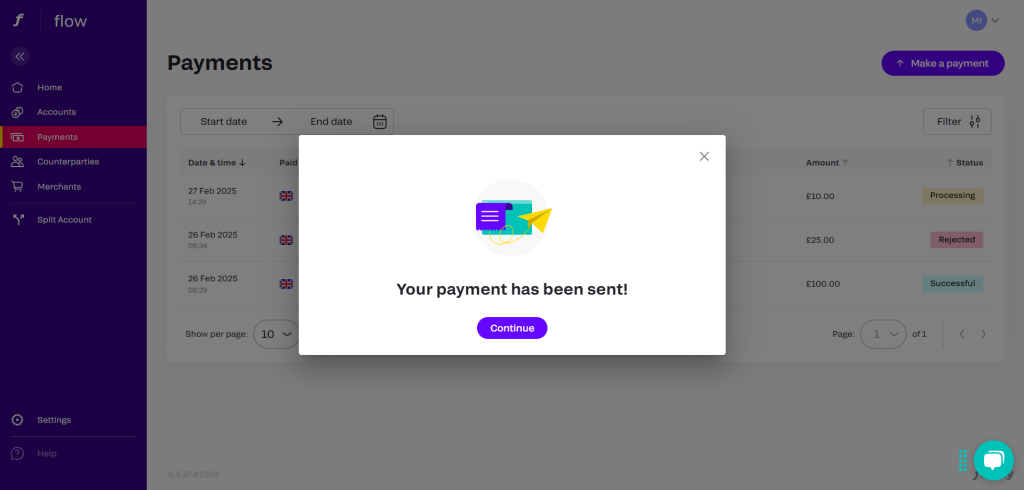

In the next menu, review the entered details. If everything is correct, click “Confirm payment”.

Great! Your payment has been sent.

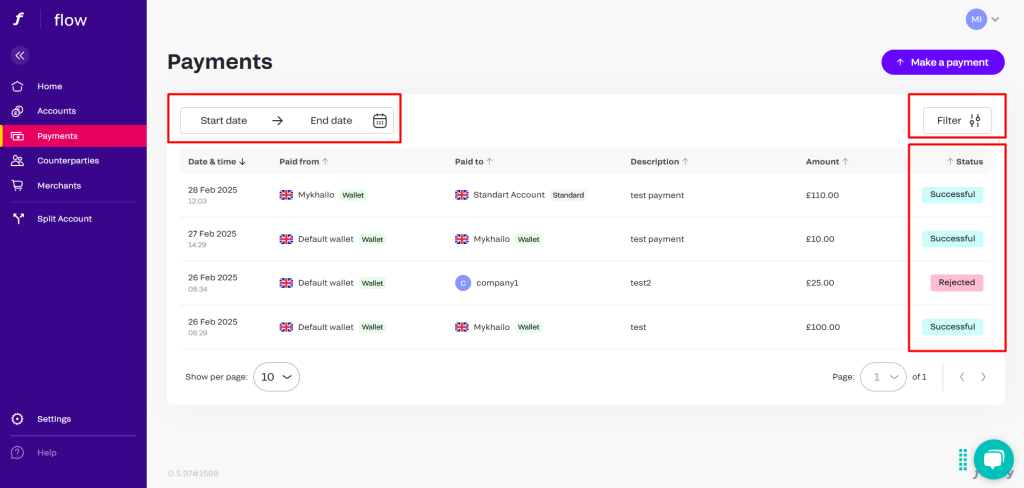

Checking payment status

To check the status of your payment, click “Continue”. The transaction will then appear in the list of payments, and its status will update within a few seconds.

Additionally, in the payments menu, you can filter transactions by date and status.

Conclusion

Creating a Fondy payment account is a straightforward process that allows businesses to efficiently manage their financial transactions. Choosing between a Standard and Master account depends on your business needs, but both provide access to a secure and flexible payment infrastructure. Once your account is funded, you can start making payments and optimizing your financial operations with ease. By leveraging Fondy’s powerful payment solutions, you ensure smooth and secure transactions for your business.

By following these simple steps, you can easily make payments and track your transactions in just a few clicks. Whether you’re sending funds externally or transferring between your own accounts, the process is designed to be quick and hassle-free.