If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Compare business accounts in the UK: features, fees, and benefits explained

In today’s dynamic business landscape, having the right financial foundation is crucial for success. For enterprises operating in the United Kingdom, selecting an appropriate business account serves as more than just a place to store funds — it’s a strategic decision that impacts daily operations, growth potential, and financial efficiency. With an overwhelming array of options available from traditional banks to innovative fintech solutions, the process of comparing business accounts can feel daunting. This comprehensive guide cuts through the complexity to help you understand what truly matters when evaluating business accounts in the UK market in 2025.

Whether you’re a startup founder, an established enterprise, or a sole trader looking to separate personal and business finances, this article will equip you with the essential knowledge to make an informed choice. We’ll explore the fundamental features, hidden fees, and genuine benefits that distinguish exceptional business accounts from merely adequate ones. By examining the nuanced differences between traditional banking institutions and modern digital alternatives, we’ll help you identify which solution aligns with your specific business requirements and growth ambitions.

Understanding the fundamentals of business accounts

Before diving into comparisons, it’s essential to understand what business accounts actually are and when they’re necessary. A business account is a dedicated banking facility designed specifically for commercial transactions, separate from personal finances. This separation isn’t just about organisation — it carries significant legal and practical implications.

For limited companies, maintaining this separation isn’t optional. UK law requires limited companies to have dedicated business accounts since the company exists as a separate legal entity from its owners or directors. The financial affairs of the business must remain distinct from personal finances to maintain proper corporate governance and comply with tax regulations.

Sole traders, while not legally obligated to open separate business accounts, often find significant advantages in doing so. As noted in our previous guide on the best business accounts for limited companies or sole traders, keeping business transactions separate dramatically simplifies accounting, tax preparation, and financial management. It creates a clear audit trail that proves invaluable during tax season or if HMRC conducts an investigation.

The fundamental differences between personal and business accounts extend beyond legal requirements. Business accounts typically offer specialised features like:

- Multiple user access with varying permission levels

- Integration with accounting software and payment systems

- Higher transaction limits suitable for commercial activities

- Detailed reporting and categorisation tools

- Business-specific customer support

- Options for accepting payments from customers

However, these enhanced features often come with different fee structures compared to personal accounts. Understanding these differences forms the foundation for making meaningful comparisons between the various business account offerings in the UK market.

Essential features to consider when comparing business accounts

When evaluating business accounts, several critical features deserve your attention. These elements can significantly impact your day-to-day operations and long-term financial management.

Account setup process and requirements

The onboarding experience varies dramatically between providers. Traditional banks typically require extensive documentation, in-person appointments, and can take weeks to approve new accounts — especially for businesses with complex structures or international connections. By contrast, digital providers often offer streamlined, fully online setup processes that can be completed in minutes. Key considerations include:

- Documentation requirements

- Identity verification methods

- Credit checks and eligibility criteria

- Timeline from application to account activation

- Necessity for in-person branch visits

Fee structures and pricing models

Business account fee structures have evolved considerably in recent years, moving beyond simple monthly charges. Modern pricing models include:

- Monthly subscription fees

- Pay-as-you-go transaction charges

- Tiered pricing based on transaction volumes

- Freemium models with premium feature upgrades

- Bundled service packages

Understanding the true cost requires looking beyond headline rates to examine specific charges for services your business regularly uses. For instance, an account advertising “free banking” might impose significant fees for cash deposits, international transfers, or exceeding transaction thresholds.

Transaction capabilities and limits

Businesses should carefully assess:

- Daily and monthly limits on transactions

- Restrictions on payment types and frequencies

- Batch payment processing capabilities

- Standing order and direct debit facilities

- Payment approval workflows for larger organisations

Transaction limits are particularly important for growing businesses, as restrictive caps can create operational bottlenecks during busy periods.

Currency options and international payment features

For businesses with international activities or aspirations, currency capabilities become crucial. Consider:

- Available currency accounts (GBP, EUR, USD, etc.)

- Foreign exchange rates and margins

- International payment fees and processing times

- Local payment methods in target markets

- IBAN and SWIFT capabilities

The difference between competitive and poor exchange rates can significantly impact profitability for businesses operating across borders.

Digital banking tools and integration capabilities

Modern business accounts should offer robust digital interfaces and seamless integration with other business systems. Evaluate:

- Mobile app functionality and user experience

- Online banking dashboard capabilities

- API availability for custom integrations

- Compatible accounting software platforms

- Automation features for recurring tasks

These technological elements aren’t merely conveniences — they directly affect operational efficiency and can reduce administrative overhead.

Customer support quality and accessibility

When financial issues arise, access to knowledgeable support becomes invaluable. Consider:

- Support hours and availability

- Communication channels (chat, phone, email)

- Dedicated account management

- Specialised business support teams

- Response time guarantees

Customer reviews on platforms like Trustpilot often highlight support quality as a key differentiator between providers, with traditional banks frequently receiving lower scores in this area compared to digital challengers.

Comparing business accounts by business type

Different business structures and stages of growth come with unique banking needs, and a one-size-fits-all approach rarely delivers the best outcomes. To find the right fit, businesses must evaluate banking options based on their specific profile and operational demands.

For startups and new businesses

Startups and new businesses often face tight cash flow in their early stages, making low initial costs a priority. They require accounts that can be set up quickly without needing an extensive trading history, while also offering scalability to support rapid growth. Integration with fundraising platforms and investor management tools is essential, as is the flexibility to adapt to evolving business models. Many providers offer startup-specific packages with initial fee waivers and growth-oriented features, which can be highly beneficial. However, businesses should carefully assess how costs may increase once these introductory offers expire to ensure long-term affordability.

For small and medium enterprises

Small and medium enterprises (SMEs) focus on cost-effective solutions that efficiently handle moderate transaction volumes. They often need multi-user access with role-based permissions to streamline operations, alongside robust reporting tools for financial planning and analysis. Seamless integration with established accounting systems and efficient cash flow management tools are also critical. For SMEs, operational efficiency is paramount, as administrative overhead can significantly erode profitability at this scale.

For established larger businesses

Larger, established businesses have more complex requirements, often needing sophisticated cash management capabilities and the ability to maintain multiple linked accounts for different departments or functions. Advanced security features, fraud protection, and international banking facilities are essential to support their broader operations. Customizable approval workflows and controls further enhance their ability to manage finances effectively. These enterprises often benefit from relationship banking models, where dedicated account managers provide tailored solutions, though such services typically come with higher fees.

For freelancers and sole traders

Freelancers and sole traders prioritize simplicity and affordability. They typically seek accounts with minimal fees to suit lower transaction volumes and straightforward interfaces that avoid unnecessary complexity. A clear separation of personal and business finances is crucial, as are basic tools for invoicing, payment collection, and expense tracking for tax purposes. For these independent professionals, the value lies in uncomplicated, cost-effective solutions rather than advanced features.

Comparing business accounts by industry needs

Beyond business size and structure, industry-specific requirements play a crucial role in determining the most suitable business account. Different industries have unique operational needs, and selecting a banking solution tailored to those needs can significantly enhance efficiency and profitability.

E-commerce and online businesses

E-commerce and online businesses thrive when their banking solutions offer seamless integration with payment gateways to streamline transactions. The ability to handle multi-currency transactions is essential for global sales, while quick settlement times help maintain healthy cash flow. Tools for managing chargebacks and fraud are critical to protect revenue, and scalable transaction processing ensures the business can handle sales peaks effectively. For online retailers, the connection between payment processing and banking directly impacts customer experience and operational efficiency, making these features a top priority.

Service-based businesses

Service-based businesses, such as professional service providers, benefit from banking solutions with sophisticated invoicing capabilities to manage client billing efficiently. Support for recurring payments and subscription management is often necessary for consistent revenue streams, while project-based financial tracking helps align finances with specific engagements. Tools for client fund management and time-saving automation features further reduce the administrative burden around billing and payment collection, allowing these businesses to focus on delivering their core services.

Retail and cash-heavy businesses

Retail and cash-heavy businesses require banking solutions that provide accessible cash deposit facilities to handle physical currency efficiently. Competitive cash handling fees are important to keep costs down, and same-day availability of deposited funds ensures liquidity for daily operations. Integration with point-of-sale systems streamlines sales processing, while efficient reconciliation tools simplify financial reporting. For businesses dealing with significant cash volumes, the location and cost of cash deposit facilities can have a substantial impact on operational expenses.

International and export businesses

International and export businesses need banking solutions that offer local banking capabilities in key markets to facilitate smooth operations across borders. Competitive foreign exchange services and international payment expertise are vital for managing global transactions effectively, while currency risk management tools help mitigate financial volatility. Compliance support for cross-border transactions ensures adherence to regulatory requirements. For businesses with global ambitions, the right international banking features can provide significant competitive advantages, enabling them to expand and operate efficiently in multiple markets.

Detailed comparison: traditional banks vs digital providers

The UK business banking landscape is increasingly divided between established high-street institutions and innovative digital challengers. Each category brings distinct advantages and limitations worth considering.

Traditional banks (HSBC, Barclays, NatWest, etc.)

Strengths:

- Extensive branch networks for in-person services

- Established lending relationships and credit facilities

- Comprehensive service offerings beyond basic banking

- Long-standing reputations and regulatory track records

- Relationship banking models for larger clients

Weaknesses:

- Typically slower account opening processes (often weeks)

- Generally higher fees for standard services

- Less intuitive digital interfaces

- More bureaucratic customer service structures

- Slower adoption of technological innovations

High-street banks continue to dominate in areas requiring complex financial advice or substantial credit facilities, but often lag in digital experience and cost-effectiveness for day-to-day banking.

Digital-first providers (Revolut, Starling, Fondy, Monzo etc.)

Strengths:

- Rapid account setup (often minutes rather than weeks)

- Rapid account setup (often minutes rather than weeks)

- Generally lower fee structures

- Innovative features and frequent platform updates

- More transparent pricing models

Weaknesses:

- Limited or no in-person service options

- Less established lending relationships

- Newer regulatory track records

- Potential challenges with complex banking needs

- Sometimes limited international banking networks

Digital providers have revolutionised business banking through technology-first approaches that dramatically improve user experience while reducing costs. However, they may not yet match traditional banks for all specialised services.

Key metrics comparison

When comparing specific providers, consider these crucial metrics:

Monthly fees:

- Traditional banks: £5-30+ monthly (often with initial free periods)

- Digital providers: £0-20 monthly (often tier-based)

Transaction costs:

- BACS/Faster Payments: £0-0.50 per transaction

- International payments: £0-40+ (significant variation)

- Cash deposits: 0.3%-3% (highly variable by provider)

International payment fees:

- Traditional banks: Typically higher fees (£15-35) plus exchange rate margins

- Digital providers: Generally lower fees (£0-15) and more competitive exchange rates

Setup time:

- Traditional banks: 2-6 weeks typically

- Digital providers: Minutes to days typically

Additional features variation:

- Traditional banks: Often bundled in premium packages

- Digital providers: Frequently à la carte or included in standard offering

Customer satisfaction:

- Traditional banks: Generally lower Trustpilot scores (1.5-2.8)

- Digital providers: Generally higher Trustpilot scores (3.7-4.5)

These metrics highlight the significant divergence in approaches between traditional and digital providers, with neither category universally superior. The optimal choice depends on specific business priorities and requirements.

Fondy business accounts: a comprehensive solution

Against this backdrop of complex choices and hidden considerations, Fondy has emerged as a standout option that addresses many common pain points in business banking. Unlike many providers that either excel at traditional banking or digital innovation, Fondy combines the best elements of both worlds.

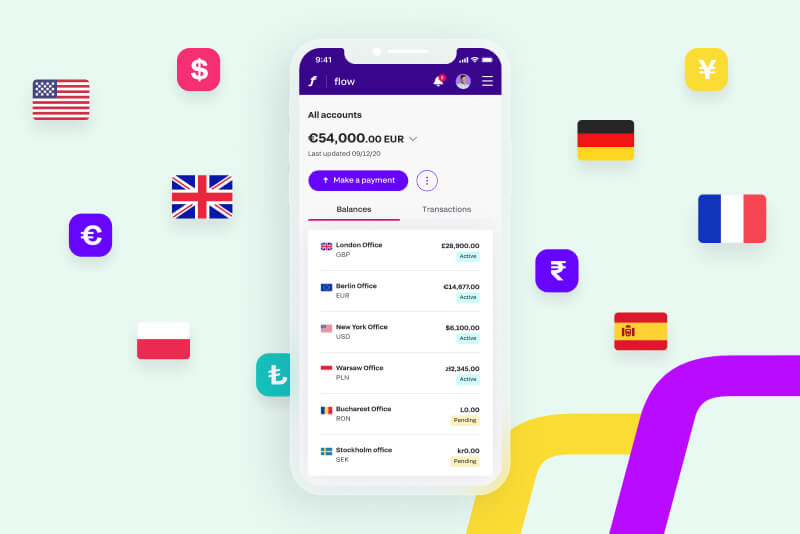

Overview of Fondy’s business account offerings

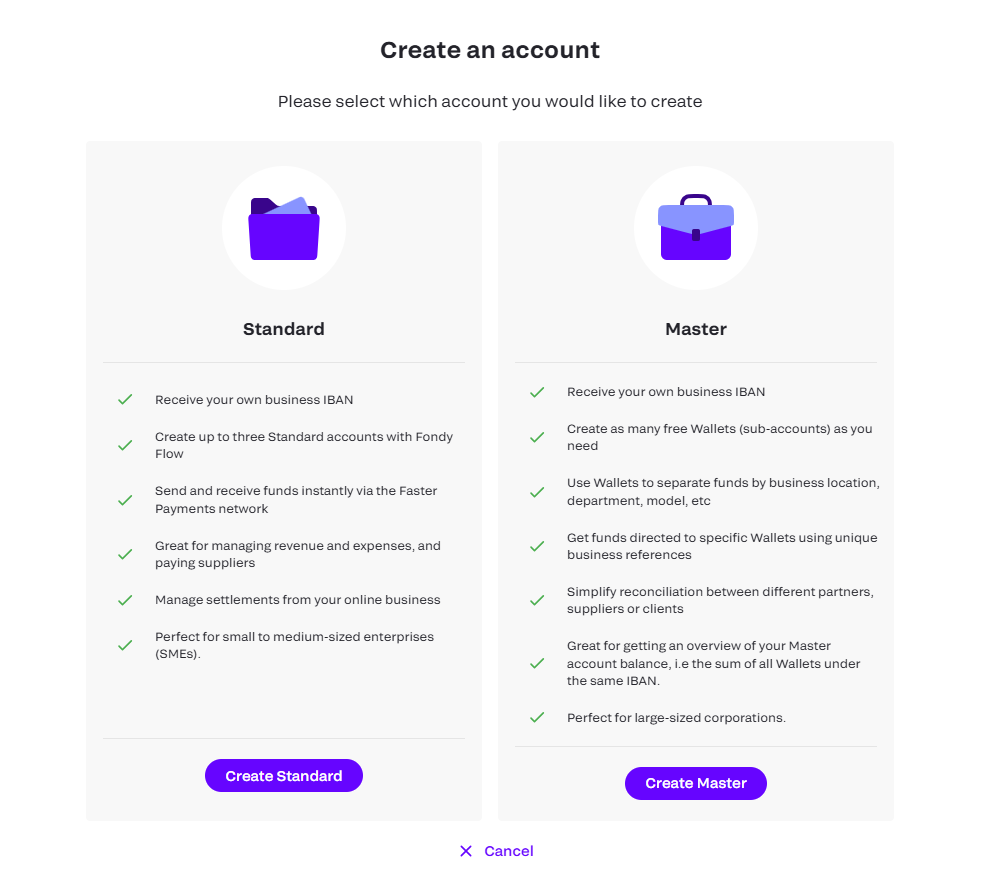

Fondy’s business account ecosystem goes beyond conventional banking to provide a comprehensive financial management platform. The core offerings include:

- Standard Account: Up to three accounts with dedicated business IBANs

- Master Account: Unlimited sub-accounts for complex financial management

- Multi-currency capability: Hold and manage GBP, EUR, and USD seamlessly

- Integrated payment gateway: Unified platform for accepting payments and managing funds

This integrated approach creates significant efficiency advantages compared to cobbling together separate banking and payment processing solutions.

Standout features compared to competitors

Several features distinguish Fondy from both traditional and digital competitors:

Instant access to funds vs traditional settlement delays

While traditional banks and many payment processors impose settlement periods of 1-3 days before funds are available, Fondy provides immediate access to received payments. This capability dramatically improves cash flow management, particularly for businesses with tight operating margins or seasonal fluctuations.

Unlimited sub-accounts with Master Account option

Fondy’s Master Account allows businesses to create unlimited sub-accounts without additional fees — a capability that exceeds what most competitors offer. This feature enables sophisticated financial organisation by:

- Separating funds by department or function

- Allocating budgets to specific projects

- Managing client funds independently

- Maintaining currency-specific accounts

- Creating dedicated accounts for tax obligations

This structure provides enterprise-level financial organisation without enterprise-level costs.

Multi-currency capabilities (GBP, EUR, USD)

While many business accounts offer multi-currency functionality, Fondy provides true currency-native accounts with dedicated IBANs for each currency. This approach eliminates the need for constant currency conversion and associated fees, creating significant savings for businesses operating across borders.

Integrated payment processing system

Perhaps Fondy’s most distinctive advantage is the seamless integration between business accounts and payment processing. This unified approach offers several benefits:

- Elimination of reconciliation challenges between separate systems

- Reduced complexity in financial management

- Lower overall fees compared to separate banking and payment solutions

- Consistent user experience across all financial functions

- Simplified compliance and reporting

This integration is particularly valuable for e-commerce businesses and other companies with substantial online payment needs.

Setup process simplicity and speed

Fondy’s account opening process exemplifies the efficiency advantages of modern fintech approaches:

- Fully online application without paperwork

- Setup completed in minutes rather than weeks

- No branch visits required at any stage

- Available to businesses without UK presence

- Straightforward identity verification procedures

This streamlined approach removes the friction traditionally associated with business account setup, allowing companies to become operational faster.

Pricing structure and transparency

Fondy’s pricing model emphasises transparency and value, with straightforward fees that avoid the complex structures common among traditional banks:

- Business accounts from £10 per month

- Card payments from 0.9% per transaction

- Open banking transactions at 0.7%

- No hidden fees or unexpected charges

- Clear scaling as businesses grow

This approach contrasts favourably with competitors who often advertise low headline rates while imposing numerous additional charges.

Security standards and regulatory compliance

As an FCA-regulated financial institution, Fondy maintains robust security standards including:

- PCI DSS Level 1 certification

- Advanced encryption for all data

- Two-factor authentication

- Full fund safeguarding

- Regular security audits and testing

These measures provide the security foundation necessary for businesses of all sizes to confidently manage their finances.

How to set up and maximise a Fondy business account

For businesses convinced by Fondy’s comprehensive approach, the setup process is refreshingly straightforward.

Simple step-by-step setup process

- Sign up and select the business account option

- Choose between Standard and Master Account structures

- Complete the online application with basic business information

- Verify business identity through the secure digital process

- Receive account details and access credentials

- Download the mobile app and log in to the web dashboard

- Begin managing payments and finances immediately

The entire process typically completes in under an hour, compared to weeks for traditional bank accounts.

Recommendations for account structure

Businesses should consider their specific needs when determining account structure:

For simpler businesses:

- Standard Account with dedicated accounts for operating expenses, taxes, and savings

For more complex operations:

- Master Account with sub-accounts organised by department, project, or function

- Dedicated currency accounts for international operations

- Separate accounts for different business lines or entities

Fondy’s flexibility allows these structures to evolve as business needs change, without requiring new account applications. If you want to know how to do everything step by step from A to Z, you can read our full guide “How to open business accounts, set up and create sub-accounts & start making global payments with Fondy”.

Integration with other business systems

To maximise efficiency, businesses should explore Fondy’s integration capabilities with:

- Popular accounting software platforms

- E-commerce systems and shopping carts

- Custom applications through the comprehensive API

- Expense management tools

- Financial reporting systems

These integrations can significantly reduce manual data entry and reconciliation work.

Conclusion: making the right choice for your business

Selecting the optimal business account requires balancing multiple factors including costs, features, scalability, and alignment with specific business requirements. While traditional banks continue to offer advantages for certain complex banking needs, the emergence of comprehensive digital solutions like Fondy has transformed the landscape by combining banking functionality with payment processing capabilities.

For modern businesses seeking flexibility, efficiency, and value, Fondy’s integrated approach addresses many common pain points associated with traditional banking. The combination of instant access to funds, unlimited sub-accounts, multi-currency capabilities, and seamless payment processing creates a compelling proposition that few competitors can match.

As the business banking sector continues to evolve, the distinction between payment services and banking functions is increasingly blurring. Forward-thinking businesses are embracing these comprehensive solutions to gain competitive advantages through improved financial efficiency and flexibility.

Whether you’re establishing a new venture or reconsidering your existing financial infrastructure, Fondy’s business accounts merit serious consideration for their unique combination of traditional banking reliability and innovative digital capabilities.