Use cases

Payments features

Payment gateway provider

Leading online payment gateway provider for UK businesses

Fondy delivers comprehensive payment gateway technology tailored for British enterprises. From emerging startups to established retail giants, our platform integrates within 24 hours without requiring technical expertise, extensive documentation, or surprise charges. Our payment processing solution adapts to your business requirements while maintaining the reliability UK merchants demand.

Why partner with Fondy’s payment gateway technology

Managing payment acceptance independently presents significant technical hurdles for UK businesses. Without an established relationship with a payment gateway provider, you’d need to negotiate individual agreements with acquiring banks, implement complex security protocols, and maintain PCI DSS compliance independently. While theoretically achievable, this approach involves substantial operational complexity and financial risk. Fondy streamlines this entire process, offering direct integration with leading British financial institutions and payment networks.

With Fondy online payment gateway provider:

– Unified integration across all major payment networks

– Accept card payments and alternative methods without development work

– Merchant account setup with minimal administrative burden

– Multi-bank processing relationships for enhanced reliability

– Built-in compliance with UK financial regulations

Without Fondy payment gateway provider:

– Individual negotiations with each payment processor

– Complex technical implementation requiring specialist knowledge

– Extensive legal and compliance documentation

– Limited to single acquiring bank relationships

– Higher risk of payment failures and security vulnerabilities

Comprehensive payment gateway technology for UK commerce

Card payments

Fondy’s payment gateway technology supports all major card networks including Visa, Mastercard, and American Express, ensuring your customers can pay using their preferred method. Our platform handles 3D Secure authentication automatically, reducing cart abandonment while maintaining the highest security standards required by UK financial authorities.

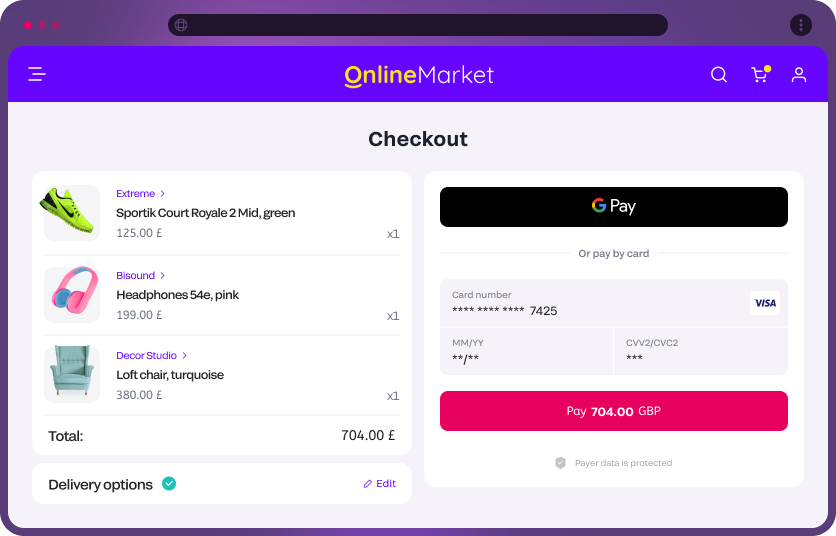

Digital payment solutions

Our online payment gateway provider integrates seamlessly with Apple Pay, Google Pay, allowing customers to complete purchases with biometric authentication. These contactless payment methods have become increasingly popular among British consumers, particularly following the pandemic’s acceleration of digital adoption.

Open banking integration

Fondy leverages the UK’s Open Banking framework to offer account-to-account payments directly through customers’ banking apps. This innovative payment gateway technology reduces transaction costs while providing instant payment confirmation, making it ideal for high-value transactions or subscription services.

UK-specific payment methods

Our platform supports Faster Payments for instant bank transfers, BACS for scheduled payments, and CHAPS for same-day high-value transactions. British customers can also use familiar local payment methods, creating a more comfortable checkout experience that drives higher conversion rates.

Deploy across every sales channel with Fondy

E-commerce integration

Transform your online store with our payment gateway technology through 30+ pre-built plugins for popular platforms like WooCommerce, Shopify, and Magento. Our REST API and comprehensive SDK library enable custom implementations that match your exact business requirements. Advanced features like smart routing ensure optimal transaction success rates across different payment methods.

Mobile commerce solutions

Integrate native payment experiences directly into your mobile applications using our iOS and Android SDKs. Support for Apple Pay and Google Pay creates frictionless checkout experiences that mobile users expect. Our React Native and Flutter libraries ensure consistent payment functionality across hybrid applications.

Omnichannel payment links

Generate secure payment links that work across any communication channel your business uses. Share these links through social media, email campaigns, WhatsApp, or embed them in chatbots. This flexibility allows businesses without traditional websites to accept payments professionally while maintaining full transaction security.

Advanced features beyond basic payment processing

Subscription management

Fondy’s recurring payment system handles subscription billing automatically, including pro-rated charges, plan upgrades, and dunning management. Our intelligent retry logic attempts failed payments at optimal times, reducing involuntary churn while maintaining positive customer relationships.

Revenue recovery tools

Recover potentially lost sales with automated abandoned cart reminders and intelligent follow-up sequences. Our system tracks customer behavior patterns and sends personalized recovery emails at optimal intervals, typically recovering 15-20% of abandoned transactions.

Automated billing cycles

Streamline your recurring revenue operations with automated billing that handles different subscription cycles, trial periods, and usage-based charges. Integration with popular accounting software ensures accurate financial reporting and tax compliance.

Instant refund processing

Process refunds immediately through our dashboard or API, with funds typically reaching customers within 24 hours. This capability is crucial for maintaining positive reviews and customer satisfaction in competitive UK markets.

Multi-party settlement

Distribute payments automatically across multiple stakeholders using our split payment functionality. Perfect for marketplaces, affiliate programs, or businesses with complex revenue-sharing arrangements. Set up percentage-based or fixed-amount splits that execute automatically with each transaction.

Enhanced fraud protection

Our payment gateway technology includes machine learning-based fraud detection that analyzes transaction patterns in real-time. Temporary authorization holds provide additional security for high-risk transactions, while maintaining smooth experiences for legitimate customers.

Flexible payout options

Optimize your cash flow with daily, weekly, or monthly payout schedules. Our system supports multiple currencies and handles foreign exchange automatically, making international business operations more manageable.

Branded checkout experiences

Customize payment pages to match your brand identity perfectly. This consistency builds customer trust and reduces the perceived risk of entering payment information, directly impacting conversion rates.

Business intelligence dashboard

Access detailed analytics covering transaction success rates, popular payment methods, and customer behavior patterns. Custom reporting helps identify optimization opportunities and supports data-driven business decisions.

Trusted by UK businesses across industries

Leading British companies across retail, hospitality, professional services, and digital commerce rely on Fondy’s payment gateway provider services. From boutique fashion retailers processing hundreds of transactions daily to major booking platforms handling millions in monthly volume, our platform scales to meet diverse business requirements while maintaining consistent performance standards.

Customer success stories

Fondy was a great partner for us in expanding our acquiring capabilities in Eastern Europe, raising the level of acquiring capabilities in the region. Their market experience has been invaluable, helping us grow across the region.

Florian Jensen

Global Fintech & Risk Director, Glovo

We started using Fondy for our eCommerce stores with vapes and CBD and highly recommend it to other eCommerce businesses.

Joshua Hegarty

Owner, GenuineCCELL

Everything in our store – from brands to products – is of the highest quality. We strive for excellence from start to finish. Fondy supports us in maintaining our high standards.

Evgenij Prichko

COO, Helen Marlen Group

Three key advantages of choosing Fondy’s online payment gateway provider

Optimized for UK market dynamics

Our payment gateway technology understands British consumer preferences and regulatory requirements. We support every major UK payment method while ensuring compliance with FCA regulations and data protection standards. This local expertise translates into higher acceptance rates and better customer experiences.

Rapid deployment capabilities

Connect your business to our online payment gateway provider within hours using our extensive plugin library or API integration. Our technical team provides hands-on support during implementation, ensuring smooth deployment without disrupting existing operations.

Industry-leading performance metrics

Achieve transaction success rates exceeding 97% through our intelligent routing technology and direct banking relationships. Our 99.9% uptime guarantee and sub-second response times ensure customers can complete purchases when they’re ready to buy.

Frequently asked questions

What makes a payment gateway provider essential for UK businesses?

A payment gateway provider serves as the technical bridge between your business and the financial institutions that process card payments. Without this connection, accepting online payments would require individual relationships with multiple banks and payment networks, complex technical integration, and ongoing compliance management. Fondy simplifies this by providing a single integration point that connects to all major payment methods used by UK consumers.

How does Fondy’s payment gateway technology benefit my business?

Fondy’s platform combines payment processing with business banking features, including virtual IBANs for collecting payments and managing cash flow. Our technology handles everything from basic card processing to complex subscription billing, while providing detailed analytics that help optimize your payment operations. The result is higher conversion rates, reduced administrative overhead, and better customer experiences.

What security measures protect transactions processed through Fondy?

Our online payment gateway provider maintains the highest security standards, including PCI DSS Level 1 certification and advanced encryption for all sensitive data. We use tokenization to replace card details with secure tokens, reducing your compliance burden while protecting customer information. Real-time fraud monitoring and 3D Secure authentication provide additional layers of protection.

How quickly can I start accepting payments through Fondy?

Most businesses can begin processing payments within 24-48 hours of application approval. Our streamlined onboarding process requires minimal documentation, and our technical team assists with integration to ensure smooth implementation. For businesses using popular e-commerce platforms, our pre-built plugins enable same-day activation.

Start accepting payments with Fondy today

Transform your payment operations with comprehensive payment gateway technology designed for UK businesses. From basic card processing to advanced business banking features, Fondy provides everything needed to optimize your payment acceptance and drive growth.

Open an account

Experience the complete capabilities of our online payment gateway provider through a personalized demonstration. See how Fondy can streamline your payment operations while improving customer satisfaction and increasing conversion rates.

Request a demo

Discover how Fondy’s payment gateway provider services can accelerate your business growth. Our team will demonstrate the platform’s capabilities and help design a payment solution that matches your specific requirements and goals.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.