Use cases

Payments features

Online payment gateway

Accept payments online with the flexible payment gateway

Fondy is more than just a payment gateway — it’s your complete online payment solution. Accept card payments, manage payouts, and track transactions through a single platform.

Seamless integration

Connect Fondy to your platform in minutes

No matter where or how you sell, our online payment gateway integration options make it easy to start

Payment links & Invoices

No website? Quickly create and share link for payment or online invoice via email, SMS, or messengers like WhatsApp. Perfect for consultants, creators, or any business selling directly to customers. Accept your first payment within minutes – absolutely no coding or or technical skills needed.

CMS plugins

Instantly accept payments by integrating one of our 30+ plugins, including Shopify, WooCommerce, Magento, PrestaShop, and more. Ideal for any business seeking a fast and simple way to start accepting online payments – completely plug-and-play, no coding required.

App SDKs

Integrate payments into your mobile app with our easy-to-use SDKs for iOS, Android and React Native. Ideal for developers who want seamless, user-friendly in-app payments with just a few lines of code.

Custom API integration

Build your own tailored checkout flow using our robust, developer-friendly APIs. Ideal for businesses needing flexibility and control, with callbacks, webhooks, and metadata to fully customize and optimize your payment processes and reporting.

Business use cases

Online payment gateway solutions tailored to your industry

Fondy is built to serve the unique needs of businesses across the UK, EU, and beyond — whether you’re selling physical products, running a subscription platform, or operating a multi-vendor marketplace. Here’s how different industries use Fondy to streamline payments, reduce overheads, and grow faster.

eCommerce

Streamline checkouts, reduce abandoned carts, and issue instant refunds. Offer one-click repeat purchases and flexible settlement options to stay competitive.

SaaS & subscriptions

Automate recurring payments, set up smart billing intervals, and handle failed charges with intelligent retries. Your customers enjoy uninterrupted access — you get reliable revenue flow.

Marketplaces & platforms

Handle complex fund distribution, vendor payouts, and fee deductions effortlessly. Create custom logic with our merchant API to split payments instantly and compliantly.

Education & EdTech

Start accepting tuition, course, or subscription fees within a day. Create a professional checkout page or integrate payments into your LMS or teaching platform.

Retail & hospitality

Skip the terminals. Let customers pay via QR codes, mobile wallets, or payment links. Whether you’re a food truck or boutique hotel, Fondy works wherever your customers are.

Professional services

Send branded invoices and get paid fast — no paper, no friction. Keep your finances centralised and transparent via your Fondy UK business account.

Getting started is easy

Get access to a UK business account, manage funds manually from day one, and upgrade to a fully automated payment gateway when you’re ready.

Create your Fondy account

Register your business online in just a few minutes. No paperwork, no appointments, and no local presence required — you can open an account from anywhere in the world.

Complete a quick verification

Go through a secure, fully digital KYC process to activate your account. Most businesses are verified within minutes and can begin managing funds the same day.

Get your UK business account

Once verified, you’ll receive a multi-currency business account with a UK IBAN. Accept funds manually, organise wallets for teams or regions, and make payouts or transfers as needed — all in one centralised dashboard.

Activate the payment gateway

If your company is registered in the UK or EU, you’re eligible to activate Fondy’s online payment gateway. Connect payment gateway for site or platform to accept card payments, automate billing, and enable seamless customer checkout experiences.

Ready to take the first step?

Connect Fondy’s powerful online payment gateway to start accepting card payments, automate checkouts, and scale your business.

Why choose Fondy?

One payment gateway. Every payment method. Unlimited growth potential.

Fondy is designed for modern businesses that want to go further, faster. From simple online payment acceptance to complex payout logic — Fondy handles it all in one place.

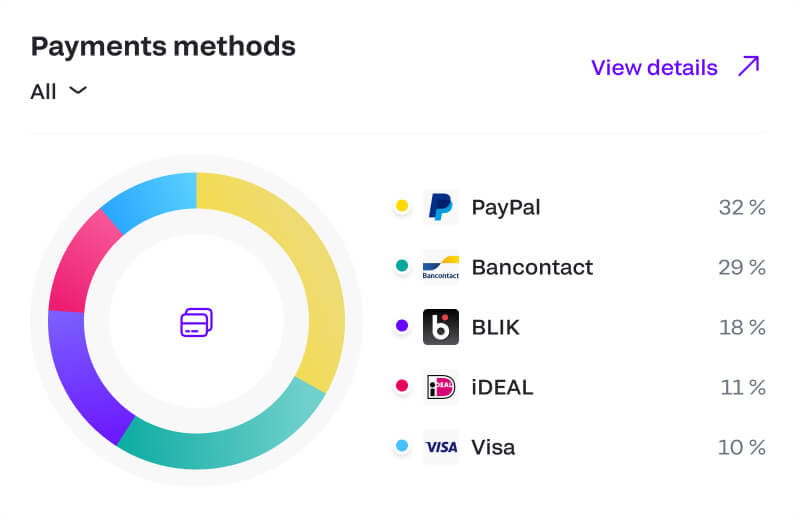

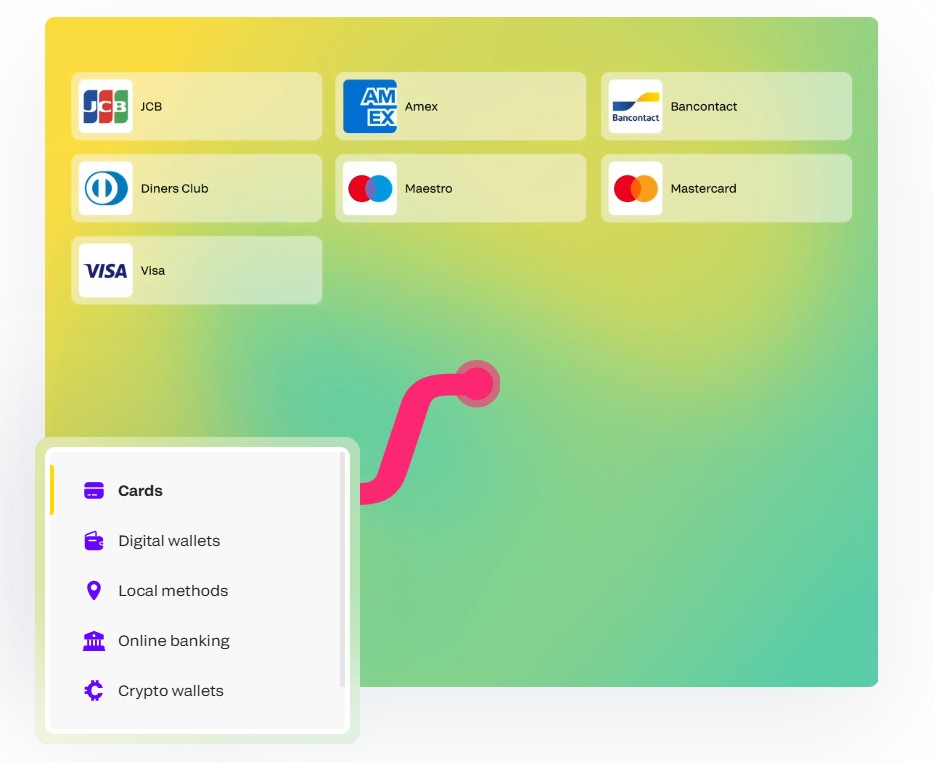

- Accept 300+ payment methods, including Visa, Mastercard, Apple Pay, Google Pay, BLIK, iDEAL, SEPA, and more

- Adaptive checkout pages that automatically display the most relevant local payment options

- PCI DSS Level 1 certification and end-to-end encryption

- Built-in support for recurring billing, subscriptions, and instalments

- Instant notifications, customer insights, and smart reporting

- Unified dashboard to manage both payments and funds

- No-code, low-code, and developer-friendly options for every business type

Whether you’re launching your first store or managing thousands of transactions per day, Fondy gives you the flexibility and tools you need to grow.

Sell globally, act locally

The online payment gateway service built for international business

Operate in the UK or the EU, and sell to customers around the world — without needing multiple providers or bank accounts. With Fondy:

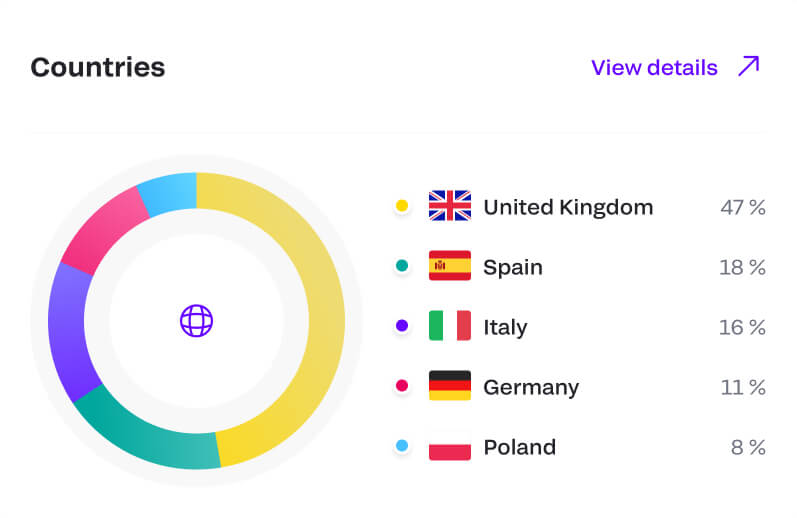

- Accept payments from 200+ countries in over 150 currencies

- Let customers pay in their local currency while you settle in yours

- Offer familiar payment experiences with local methods (e.g. BLIK in Poland, iDEAL in the Netherlands)

- Avoid unnecessary conversions and foreign exchange fees

Thanks to intelligent geolocation, each customer sees the payment methods they trust — increasing conversions and reducing cart abandonment.

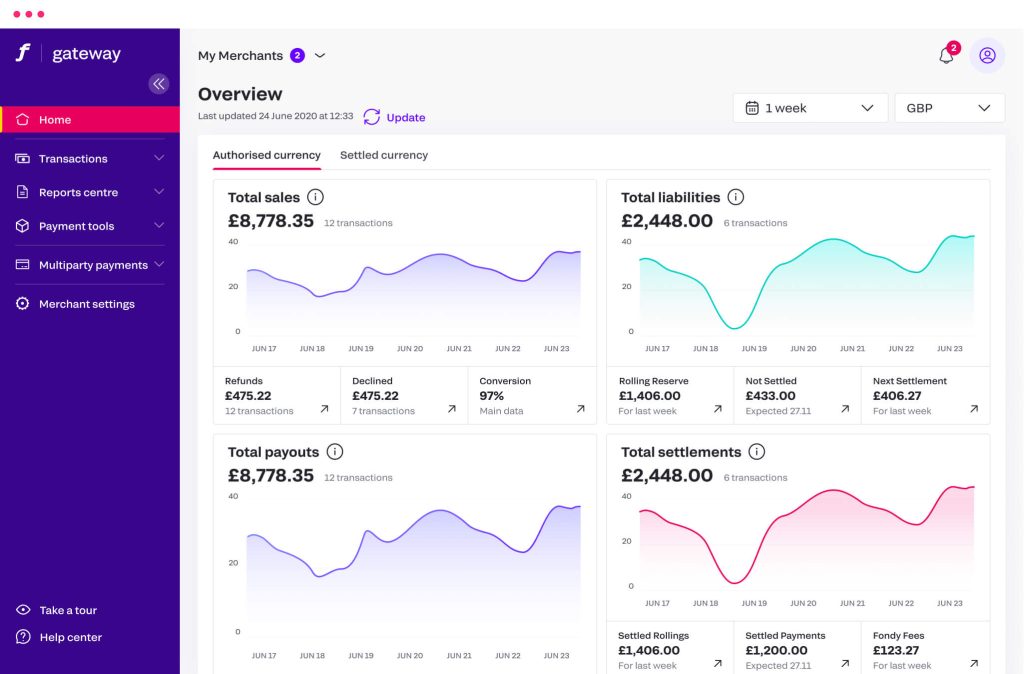

Track and manage your entire payment flow from a single portal

View incoming transactions by channel, method, and location

Monitor authorisation rates and failed payments in real time

Generate downloadable reports by day, week, or custom period

Set up automatic notifications and payment event alerts

Manage refunds, settlements, and transfers between wallets

Analyse performance across countries, products, or teams

Bank-grade security

Your data and your customers’ data are protected by the highest industry standards. Fondy’s infrastructure is PCI DSS Level 1 certified, ensuring secure payment processing of all transactions. All accounts are protected with two-factor authentication and full encryption.

We use real-time fraud detection and rule-based transaction filtering to identify and block suspicious activity. Fondy is authorised and regulated by the UK Financial Conduct Authority (FCA) as an electronic money institution. All client funds are safeguarded and held separately from Fondy’s own operational accounts.

Security isn’t an optional feature — it’s built into every layer of our platform.

Get a free business account with your Fondy setup

A payment gateway that comes with a business account in the UK

When you register with Fondy, you instantly receive a UK-based multi-currency business account.

Accept and send business payments in GBP, EUR, and USD — no paperwork, no waiting, no need to visit a branch.

Use it standalone or integrate it with Fondy’s online payment gateway for a full business payment ecosystem.

This account is available to all businesses — including non-UK and non-EU residents.

Whether you’re based in, you can still enjoy all the benefits of a UK financial infrastructure.

Not just a way to get paid – a smarter online payment gateway

Fondy’s payment gateway is built for businesses that want to grow faster, simplify operations, and offer frictionless customer experiences. Here’s how Fondy stands out compared to traditional payment providers:

Built for cross-border payments

Go beyond local transactions. Fondy enables you to accept payments from 200+ countries in 150+ currencies. Our smart checkout adapts automatically to the customer’s location, showing familiar and trusted payment methods that drive higher conversion.

Flexible checkout experience

Offer fully adaptive payment pages optimised for all devices and platforms. Fondy’s checkout is available in 19 languages and supports one-click payments, subscriptions, and saved card details for returning customers.

Fast setup, fast go-live

Start accepting payments in just one day. Fondy offers quick onboarding, instant verification, and no need for complex development. Whether you’re using plugins, payment links, or our API — going live is fast and simple.

Integrated payouts and automation

With Fondy, incoming payments flow directly into your business account, and payouts can be automated to suppliers, freelancers, or partners. Set custom rules or use our API to streamline finance operations.

What our customers say

Fondy has been a great partner for us when it comes to expanding our acquiring capabilities in Eastern Europe, leveling up the region’s acquiring capabilities. Their experience in the market has been invaluable, helping us scale across the region.

Florian Jensen

Global Fintech & Risk Director, Glovo

We are so pleased to have met such a reliable partner, we have enjoyed working alongside them for many years as the main payment system for card processing.

Aleksej Yuhimchuk

Co-founder, Rocket

Everything in our store – from the brands to the products are of the utmost quality. We strive for perfection from start to checkout. Fondy support us to maintain our high standards.

Evgenij Prichko

COO, Helen Marlen Group

Featured in

Frequently asked questions

Can I use Fondy if I’m not based in the UK or EU?

Yes. You can open a UK-based business account with Fondy from anywhere in the world. While our payment gateway is primarily available to UK and EU businesses, the business account is open to non-residents. It’s ideal for managing global transactions within a unified financial system.

Do I need a UK company to access the payment gateway?

To access full gateway functionality and local acquiring, your business should be registered in the UK or EU. However, you can still open a UK business account from outside these regions and manage international payments with ease in manual mode.

What are the fees?

We offer transparent pricing tailored to your needs. No setup fees. You only pay for what you use. Card payments start at 0.9%, and business accounts from £10/month. We support a wide range of payment methods, including all major credit bank cards and local payment options.

Which payment methods are supported?

Fondy supports 300+ methods, including Visa, Mastercard, Apple Pay, Google Pay, PayPal, SEPA, BLIK, iDEAL, and more. This includes all major debit and credit bank cards, as well as region-specific methods to ensure optimal conversions across markets.

Can I manage everything from one place?

Yes. Your payment gateway and business account are fully integrated into one dashboard. This includes access to real-time reports, automation tools, and a secure internet payment gateway designed to simplify and scale your business operations.

Accept payments, manage funds, and grow

Grow your business with an all-in-one platform for payments and financial control

All with Fondy

Fondy is more than just an online payment gateway — it’s a complete solution trusted by UK businesses to manage payments, automate finances, and scale with confidence.

Let`s start

From instant onboarding to global transactions, Fondy supports your growth at every step.

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.