If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

The best international business accounts for cross-border payments

In today’s interconnected global economy, businesses of all sizes are breaking down geographical barriers and expanding their reach across borders. Whether you’re an e-commerce retailer selling to customers worldwide, a freelancer working with international clients, or a growing company establishing operations in new markets, having the right financial infrastructure is crucial for success. The cornerstone of this infrastructure is an international business account that can handle cross-border payments efficiently and reliably.

The landscape of international business banking has transformed dramatically over the past decade. Traditional banks now compete with innovative fintech solutions that offer faster processing times, lower fees, and better exchange rates. This shift has created both opportunities and challenges for businesses seeking the best international business accounts for their specific needs.

Essential features to look for

When evaluating international business accounts, certain features distinguish truly effective solutions from basic offerings. Understanding these key capabilities will help you make an informed decision that aligns with your business requirements.

- Multi-currency functionality The ability to hold, receive, and send payments in multiple currencies without constant conversion saves significant money on exchange rates. Leading providers offer accounts supporting dozens of currencies, allowing businesses to maintain balances in their most-used currencies and avoid unnecessary conversion fees.

- Exchange rates and fee transparency Hidden fees and unfavourable exchange rates can erode profit margins, particularly for high-volume businesses. The best business accounts for international payments provide real-time exchange rates close to the mid-market rate, with clear, upfront pricing structures that enable accurate financial planning.

- Integration capabilities Modern international business accounts should seamlessly connect with popular accounting software, e-commerce platforms, and ERP systems. API availability allows for custom integrations, enabling businesses to automate payment processes and maintain accurate financial records.

- Transaction limits and processing times While some providers impose restrictive limits on transaction sizes or monthly volumes, others offer flexible terms suitable for growing businesses. Processing times vary significantly, with some offering near-instantaneous transfers while others may take several business days.

- Compliance and regulatory features Reputable providers maintain necessary licences in multiple countries, handling complex compliance requirements including anti-money laundering procedures, know-your-customer verification, and adherence to international banking regulations.

Traditional banks vs digital solutions

The choice between traditional banks and digital-first solutions for international business banking involves weighing several factors that can significantly impact your operations and bottom line.

Traditional banks bring established reputations and extensive physical networks to international banking. These institutions often provide comprehensive financial services beyond basic banking, including trade finance and business loans. Their long-standing relationships with correspondent banks worldwide can facilitate transactions in less common currencies or challenging markets. However, traditional banks typically charge higher fees and offer less competitive exchange rates. Their legacy systems often result in slower processing times, with international wire transfers taking three to five business days.

Digital solutions have revolutionised international business banking by leveraging technology to reduce costs and improve efficiency. These platforms typically offer significantly better exchange rates, often within a small margin of the mid-market rate. Transaction fees are generally lower and more transparent. Processing times are notably faster, with some transfers completing within hours. The digital-first approach also translates to superior user experiences, with account opening often completed entirely online within days.

Top international business account providers

The market for international business accounts has become increasingly competitive, with providers differentiating themselves through unique features, pricing structures, and target markets. Understanding the strengths and limitations of each option helps businesses select the most suitable solution for their specific needs.

Digital-first solutions

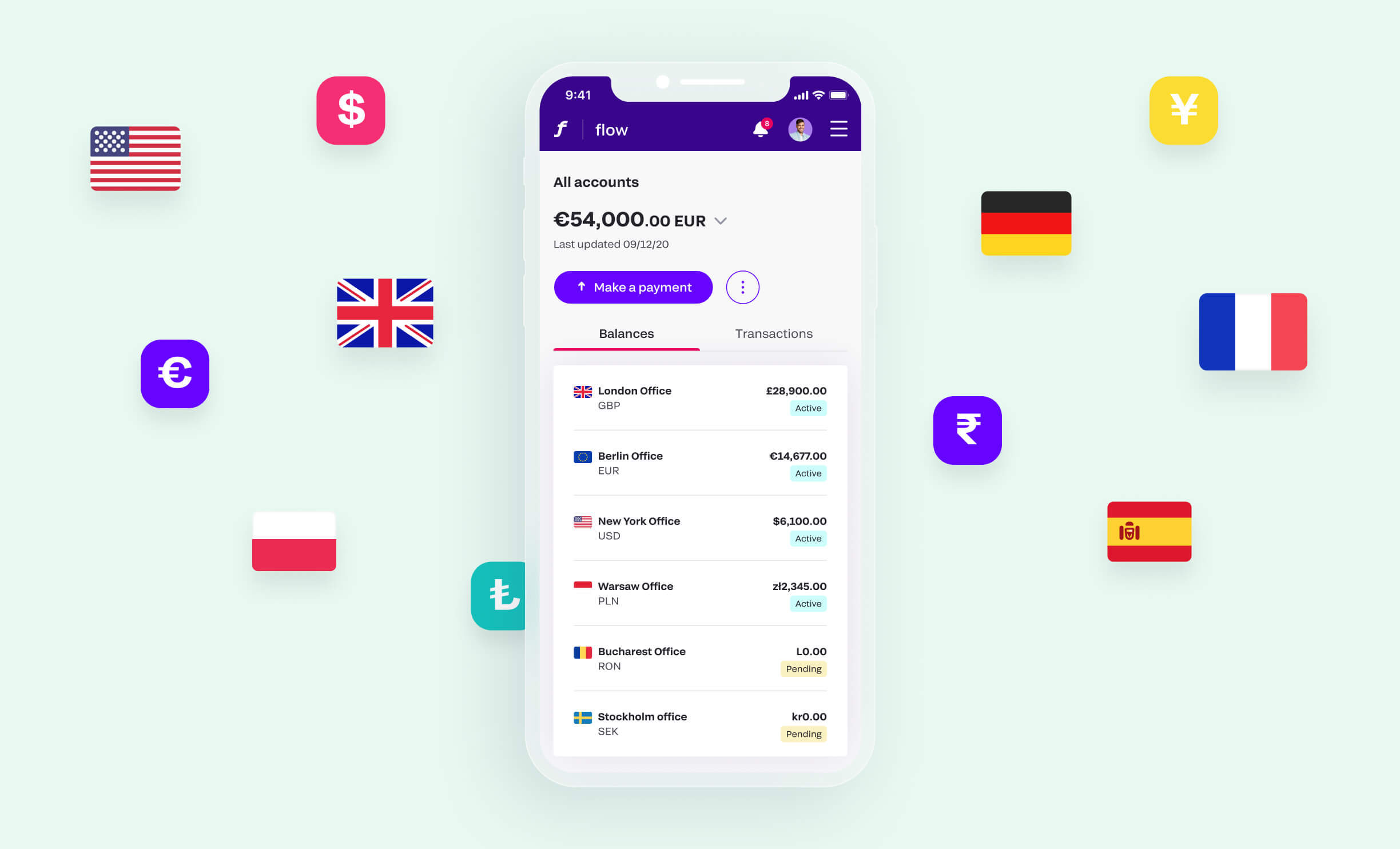

Fondy stands out as a comprehensive solution that goes beyond traditional international business accounts. As a payment service provider, Fondy offers businesses the ability to accept payments in over 200 payment methods across more than 100 countries. What sets Fondy apart is its integrated approach to international payments – rather than simply facilitating transfers, it provides a complete ecosystem for global commerce. The platform supports real-time currency conversion with competitive rates, ensuring businesses can accept payments in their customers’ preferred currencies while receiving settlements in their chosen currency. Fondy’s advanced fraud protection systems use machine learning to identify and prevent fraudulent transactions, particularly important for cross-border commerce where risk levels can be higher. The platform also offers features like payment splitting, allowing to automatically distribute incoming business payments between multiple recipients or accounts – ideal for marketplace models or businesses with complex partnership structures.

Wise Business has established itself as a leader in transparent, low-cost international transfers. The platform provides multi-currency accounts with local banking details in multiple countries, enabling businesses to receive payments like a local company. Wise’s commitment to mid-market exchange rates and transparent fee structures has made it popular among small to medium-sized businesses. The platform excels in peer-to-peer currency matching, which helps keep costs low for popular currency routes. Integration with accounting software and batch payment capabilities make it suitable for businesses with regular international payment needs.

Revolut Business offers a feature-rich platform combining international payments with broader financial management tools. Beyond multi-currency accounts and competitive exchange rates, Revolut provides expense management features, corporate cards, and team spending controls. The platform’s strength lies in its all-in-one approach, making it attractive for businesses seeking to consolidate their financial operations. However, some users report challenges with customer support during peak times, and certain advanced features require higher-tier subscriptions.

Payoneer specialises in serving online businesses, freelancers, and marketplaces. The platform excels in receiving payments from major marketplaces and platforms, making it popular among e-commerce sellers and digital service providers. Payoneer’s global payment service provides receiving accounts in multiple currencies, though its fee structure can be less competitive for larger transactions compared to some alternatives.

Traditional banks with international focus

HSBC International leverages its global presence to offer comprehensive international banking services. With operations in over 60 countries, HSBC provides businesses with genuine global reach and the ability to maintain relationships across multiple markets. The bank’s international business accounts include features like multi-currency accounts, trade finance facilities, and dedicated relationship managers for larger clients. While fees tend to be higher than digital alternatives, some businesses value the stability and comprehensive services offered.

Citibank Global provides sophisticated international banking solutions primarily targeted at larger corporations and high-growth businesses. The bank’s strength lies in its cash management capabilities, allowing businesses to optimise their global cash positions and manage complex treasury operations. Citibank’s extensive network facilitates transactions in emerging markets where digital-only providers may have limited reach.

Hybrid solutions

Airwallex combines elements of traditional banking relationships with modern technology to serve growing businesses. The platform offers multi-currency accounts, international payments, and expense management tools, positioning itself as a comprehensive financial operating system for global businesses. Airwallex’s strength lies in its focus on the Asia-Pacific region while maintaining global capabilities.

WorldFirst specialises in serving e-commerce businesses and online sellers, particularly those operating on major marketplaces. The platform provides competitive exchange rates and has built integrations with popular e-commerce platforms. Following its acquisition by Ant Financial, WorldFirst has expanded its capabilities in Asian markets while maintaining its strong presence in Western markets.

How to choose the right account for your business

Selecting the optimal international business account requires careful consideration of your specific needs and growth plans. Transaction volume and frequency play crucial roles in determining the most cost-effective solution. Businesses with high-volume, regular transactions benefit from providers offering volume discounts or flat-fee structures.

The geographical scope of your operations significantly influences the choice of provider. Companies dealing with emerging market currencies need providers with broader geographical coverage. Fondy’s extensive coverage of over 100 countries makes it particularly suitable for businesses with diverse international operations.

Industry-specific requirements often dictate certain features. E-commerce businesses benefit from marketplace integrations, while B2B companies might prioritise bulk payment capabilities. Integration requirements with existing business systems deserve careful attention, as robust APIs can significantly improve operational efficiency.

Opening your international business account

The account opening process varies between providers, but understanding common requirements helps ensure a smooth experience:

- Documentation requirements Most providers require business registration documents, proof of address, identification for directors, and evidence of business activities. Digital providers often accept electronic copies, while traditional banks may require certified documents.

- Verification process Providers use various methods to confirm business legitimacy, including video calls, background checks, and verification of business websites. While these procedures can seem onerous, they protect legitimate businesses from fraud.

- Common obstacles Incomplete documentation, inconsistencies in information, and businesses in restricted industries face additional scrutiny. Understanding these challenges allows businesses to address them proactively.

- Timeline expectations Digital solutions like Fondy often complete account opening within 24-48 hours, while traditional banks typically require two to four weeks. Planning ahead prevents operational disruptions.

Optimising international payments

Maximising the value from your international business account requires understanding and implementing best practices for cross-border transactions. These strategies can significantly reduce costs and improve cash flow management.

Currency conversion timing can impact transaction costs substantially. Exchange rates fluctuate constantly, and businesses conducting regular international transactions benefit from monitoring rate trends and timing conversions strategically. Some providers offer forward contracts or rate alerts, enabling businesses to lock in favourable rates or execute transactions when predetermined rate targets are met. However, attempting to time the market perfectly often proves counterproductive for most businesses, and establishing regular conversion schedules may provide more predictable costs.

Batch processing represents an effective strategy for businesses with multiple payments to the same currency or region. Rather than processing individual transactions, combining payments reduces per-transaction fees and may qualify for volume discounts. Many providers offer batch upload features, allowing businesses to process hundreds of payments simultaneously through CSV file uploads or API integrations.

Risk management in international payments extends beyond exchange rate considerations. Businesses should implement approval workflows for large transactions, maintain detailed records for compliance purposes, and regularly review transaction patterns for anomalies. Providers like Fondy that offer advanced fraud protection and real-time monitoring help businesses identify and prevent unauthorised transactions before they cause significant damage.

Understanding and optimising the fee structure of your chosen provider can generate substantial savings. Some providers offer subscription plans that include a certain number of free transactions or reduced fees. Others provide volume-based pricing that becomes more attractive as transaction volumes increase. Regularly reviewing your fee structure and negotiating with providers based on your transaction history can reduce costs significantly.

Why Fondy stands out for international business

Fondy distinguishes itself through a comprehensive approach addressing the full spectrum of global commerce needs:

- Unmatched global reach Support for over 200 payment methods across 100+ countries means businesses can accept payments using customers’ preferred local methods, significantly improving conversion rates.

- Integrated payment ecosystem Beyond simple transfers, Fondy enables sophisticated payment flows including subscription billing, marketplace payments, and split payments that automatically distribute funds between multiple parties.

- Advanced security features Machine learning-powered fraud protection provides essential security for international transactions, analysing patterns in real-time while minimising false positives.

- Seamless integration Comprehensive APIs and pre-built plugins for popular platforms make implementation straightforward, allowing businesses to maintain existing infrastructure while adding powerful international capabilities.

- 24/7 multilingual support Round-the-clock assistance ensures businesses receive help when needed, with support teams understanding the complexities of international payments and regulatory requirements.

Conclusion

Selecting the best international business account for cross-border payments requires careful consideration of your business’s unique needs and growth ambitions. The landscape has evolved far beyond traditional banking options, with innovative digital solutions offering faster, cheaper, and more flexible alternatives for global commerce.

The key to success lies in choosing a provider that aligns with your business model and provides room for growth. For businesses seeking a truly integrated approach to international payments, solutions like Fondy that combine payment gateway functionality with multi-currency capabilities provide compelling advantages.

As global commerce continues to expand, having the right financial infrastructure becomes increasingly critical. By carefully evaluating options and implementing best practices, businesses can turn cross-border payments from a challenge into a competitive advantage.