If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Startup business accounts: how to choose the best option for your UK business

Launching a startup in the UK requires more than just a brilliant idea and unwavering determination. Behind every successful venture lies a robust financial foundation, and at the heart of this foundation sits the right startup business account. Unlike established businesses with predictable cash flows and steady operational patterns, startups face unique challenges: rapid scaling demands, irregular income streams, urgent funding requirements, and the constant need to demonstrate credibility to investors, suppliers, and customers.

The landscape of startup business accounts has transformed dramatically in recent years. Where once entrepreneurs were limited to traditional high-street banks with lengthy approval processes and rigid structures, today’s founders can choose from a diverse ecosystem of digital-first providers, fintech innovators, and hybrid solutions specifically designed for fast-growing ventures. The challenge is no longer finding an account, but identifying which financial partner can truly accelerate your startup’s journey from concept to scale.

This comprehensive guide examines everything you need to know about startup business accounts in the UK, from essential features that support rapid growth to advanced capabilities that prepare your venture for international expansion. We’ll explore how providers like Fondy have revolutionised startup banking by combining traditional reliability with modern flexibility, creating platforms that don’t just store money but actively support business development.

Understanding startup-specific banking requirements

Startup business accounts differ fundamentally from standard small business banking solutions because they must accommodate the unique characteristics of high-growth ventures. Traditional business accounts are designed for established operations with predictable patterns, but startups operate in a state of constant evolution, requiring financial tools that can adapt at pace.

The most critical requirements for startup founders include:

- Speed and accessibility: When opportunities arise, when funding becomes available, or when urgent payments are needed, delays can be costly. Modern startup business accounts must provide instant access to funds, rapid transaction processing, and immediate account setup without the bureaucratic delays that characterise traditional banking.

- Flexible fund management: Startups often need to segregate money for different purposes: operational expenses, marketing campaigns, product development, or investor funds held in escrow. The best business accounts for startups offer sophisticated sub-account structures that allow founders to maintain clear financial organisation without managing multiple banking relationships.

- Professional credibility: Investors, suppliers, and customers expect startups to operate with professional banking arrangements. A dedicated business account signals legitimacy and separates personal finances from business operations, which is crucial for both regulatory compliance and maintaining clear financial records for due diligence processes.

- Scalability for growth: What works for a two-person startup may become inadequate when the team grows to twenty employees across multiple departments. The right account should grow seamlessly with the business, adding features and capabilities without requiring disruptive migrations or system changes.

The evolution of startup banking in the digital age

The digitalisation of banking has been particularly beneficial for startups, removing many traditional barriers that once made business banking inaccessible for new ventures. Online account opening, automated compliance checks, and instant verification processes mean that entrepreneurs can establish professional banking within hours rather than weeks.

This digital transformation has also enabled innovative features specifically designed for startup needs. Real-time spending analytics help founders monitor burn rates and runway calculations. Automated expense categorisation simplifies financial reporting and tax preparation. Integration capabilities connect banking with accounting software, payment processors, and business management tools, creating seamless operational workflows.

Modern startup business accounts also offer enhanced collaboration features. Multiple team members can access accounts with granular permission controls, allowing CFOs to maintain oversight while enabling department heads to manage their budgets independently. This collaborative approach is essential for startups that operate with distributed teams or remote-first cultures.

The shift towards API-first banking has been particularly transformative. Startups can now integrate their banking directly with custom software solutions, e-commerce platforms, or specialised industry tools, creating automated financial workflows that reduce manual overhead and improve accuracy.

Multi-currency capabilities for global ambitions

Most UK startups have international aspirations from day one, whether targeting global markets, sourcing from overseas suppliers, or attracting international investment. Traditional banking makes international operations expensive and complex, but modern startup business accounts have simplified cross-border finance significantly.

At minimum, look for accounts that support major currencies like GBP, EUR, and USD with competitive exchange rates and transparent fees. Many startups discover that traditional banks embed significant margins into their exchange rates, creating hidden costs that compound over time.

More sophisticated accounts provide local bank details in multiple countries, allowing startups to appear local to international customers and receive payments more efficiently. This capability is particularly valuable for SaaS companies, e-commerce ventures, or consulting businesses that serve global markets from their UK base.

For startups planning rapid international expansion, consider accounts that offer additional services like forward contracts to hedge against currency fluctuations, or bulk payment capabilities to manage international payroll or supplier payments efficiently.

Assessment criteria for startup business accounts

Before comparing specific providers, it’s essential to understand your startup’s particular requirements. Different types of startups have vastly different banking needs, and choosing an account that doesn’t align with your business model can create unnecessary friction and costs.

- Transaction patterns analysis: Consider your transaction volume and types first. E-commerce startups typically process high volumes of small transactions and need seamless integration with payment processors. SaaS companies require recurring payment management and automated subscription handling. Consulting firms might prioritise invoicing features and expense management tools. Manufacturing startups need supply chain finance capabilities and inventory management integration.

- Growth trajectory planning: Growth projections are equally important. If you’re planning to raise funding, ensure your account can handle large capital injections without triggering compliance issues. If international expansion is likely, prioritise multi-currency capabilities and global payment processing. If team scaling is expected, look for collaborative features and advanced permission management.

- Technical requirements evaluation: Some startup teams have sophisticated technical capabilities and can benefit from advanced API integration and custom workflow automation. Others prefer straightforward, user-friendly interfaces without complex technical requirements.

- Industry-specific considerations: Finally, consider your industry’s specific needs. Fintech startups require enhanced compliance and regulatory reporting capabilities. Healthcare ventures need GDPR-compliant data handling. Retail businesses benefit from point-of-sale integration and inventory management connections.

Competitive landscape analysis: pricing and features

Understanding the current market helps identify which providers offer genuine value for startup-specific requirements. The landscape includes traditional banks, digital-first challengers, and specialised fintech top providers, each with distinct advantages and limitations.

Revolut charges a fixed £5 per international transfer, making it attractive for startups with regular international payments. However, Revolut Business often requires separate systems for payment processing, creating integration challenges for e-commerce or SaaS startups.

Starling Bank offers accounts with no monthly fees, which appeals to cost-conscious startups. Their mobile-first approach and clean interface are well-regarded, but they lack the advanced sub-account flexibility that growing startups often require for financial organisation.

Monzo Business provides an intuitive mobile app and good expense management features, but their international transfer fees are variable and start at 0.33% depending on currency, meaning at least £6.60 on a £2,000 transfer. For startups with international operations, these costs accumulate quickly.

Traditional high-street banks like HSBC, Barclays, and NatWest offer comprehensive service portfolios but typically require lengthy approval processes, extensive documentation, and often impose minimum balance requirements that can be challenging for early-stage startups.

Tide offers accounts under four plans, with one free option ideal for startups, though other plans range from £9.99 to £49.99 monthly. Tide excels in digital setup speed and basic banking functionality but struggles with advanced multi-currency operations and higher transaction volumes. Their free tier works well for very early-stage startups with minimal transaction needs.

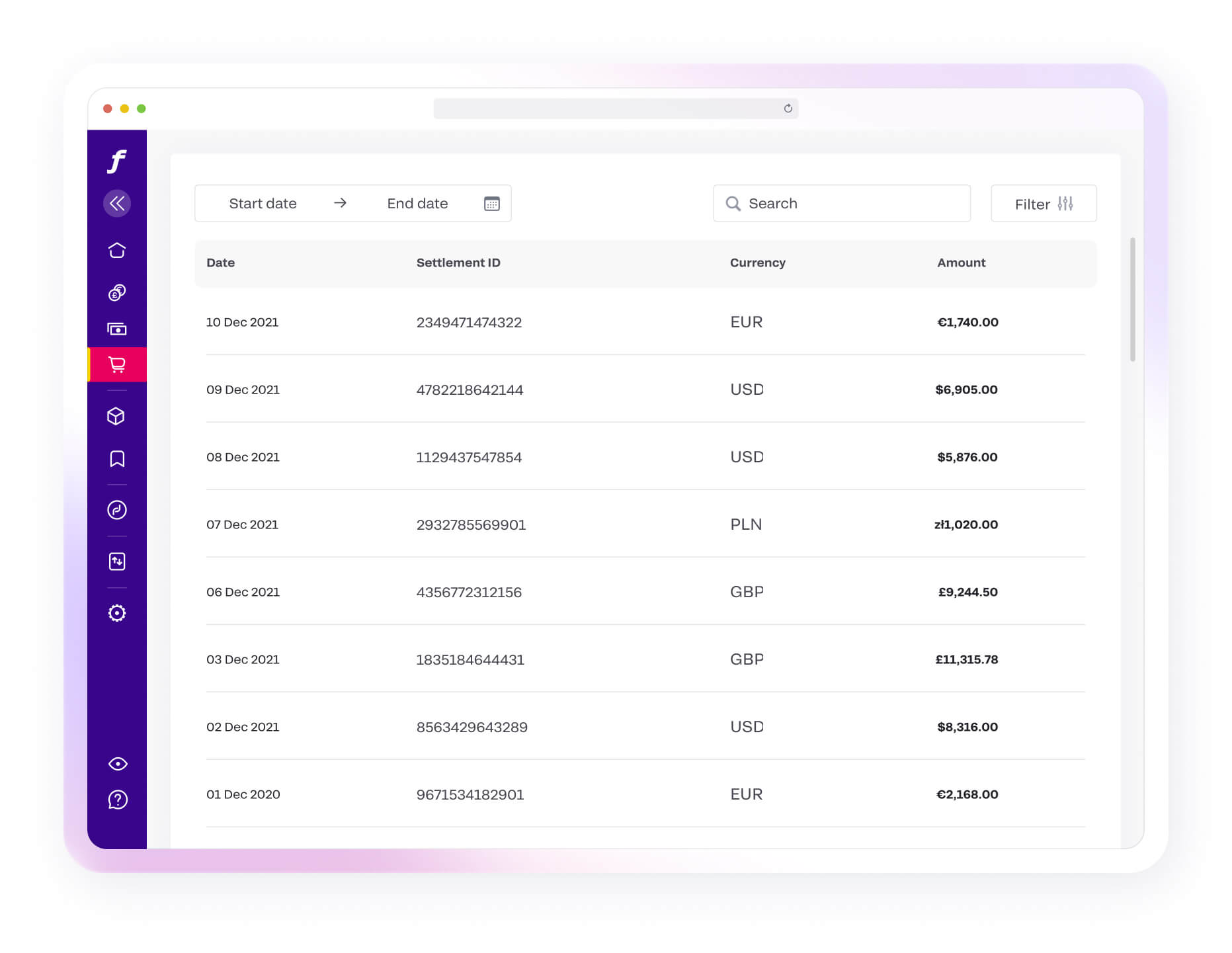

Fondy offers online business accounts with transparent pricing starting from £10 monthly for their Standard Account, with unlimited sub-accounts available through their Master Account option. Unlike competitors that excel in isolated areas, Fondy combines comprehensive banking functionality with integrated payment processing, competitive multi-currency support, and API-first architecture.

Why Fondy excels for startup requirements

Fondy has designed its platform specifically to address the unique challenges that startups face, combining essential banking functionality with advanced features that support rapid growth and international expansion. Unlike competitors that excel in one area while creating limitations in others, Fondy provides a comprehensive solution that evolves with startup needs.

The most significant advantage is Fondy’s account structure flexibility. Startups can begin with a Standard Account that includes up to three separate accounts under one profile, each with its own IBAN. This allows founders to separate different revenue streams, hold investor funds separately, or allocate money for specific projects without additional complexity or cost.

As startups grow, they can seamlessly upgrade to Fondy’s Master Account, which provides unlimited sub-accounts (wallets) for sophisticated financial organisation. This scalability is crucial for startups that experience rapid growth, as it eliminates the need to migrate banking systems when operational complexity increases.

Fondy’s integrated payment gateway sets it apart from pure banking providers. Startups can accept customer payments, manage incoming funds, and automate settlement processes from the same platform they use for banking. This integration reduces technical overhead, improves cash flow management, and simplifies financial reconciliation.

For international operations, Fondy provides competitive multi-currency support with transparent pricing and real exchange rates. Unlike traditional banks that embed margins into currency conversions, Fondy’s transparent approach helps startups understand their true international transaction costs and plan accordingly.

The platform’s API-first architecture enables sophisticated integrations that growing startups need. Whether connecting to accounting software, e-commerce platforms, or custom business applications, Fondy’s technical infrastructure supports the automated workflows that enable startups to scale efficiently.

Security and compliance for startup confidence

Startups often handle sensitive customer data, investor information, and proprietary business intelligence, making security a critical consideration when choosing banking partners. Fondy addresses these concerns through comprehensive security measures that match or exceed traditional banking standards.

As a provider regulated by the UK Financial Conduct Authority and certified to PCI DSS Level 1, Fondy maintains institutional-grade security protocols including advanced encryption, multi-factor authentication, and sophisticated fraud detection systems. For startups handling customer payments or sensitive financial data, these protections are essential for maintaining trust and regulatory compliance.

This regulatory compliance extends beyond technical security to encompass transparency, accountability, and business practices. When startups work with investors, undergo due diligence processes, or prepare for acquisitions, having banking relationships with properly regulated providers demonstrates operational maturity and risk management sophistication.

The compliance infrastructure also supports startups as they grow into more complex regulatory environments. Whether expanding internationally, handling larger transaction volumes, or operating in regulated industries, Fondy’s compliance foundation provides the stability that scaling startups require.

Cost transparency and predictable pricing

One of the most frustrating aspects of traditional business banking for startups is unpredictable pricing. Hidden fees, unexpected charges, and complex pricing structures can create budget uncertainty that cash-conscious startups cannot afford.

Fondy addresses this challenge through transparent, upfront pricing that allows startups to predict their banking costs accurately. Whether using basic accounts for simple operations or scaling up to Master Accounts with advanced features, pricing remains clear and predictable.

This transparency extends to international operations, where many providers disguise costs through poor exchange rates or hidden fees. Fondy’s straightforward approach to multi-currency operations helps startups understand the true cost of international business and make informed decisions about global expansion.

The flexible pricing structure also means that startups pay for what they need when they need it. Early-stage ventures can access essential banking functionality at low cost, then add advanced features as their requirements and budget grow.

Supporting startup growth through intelligent features

Beyond basic banking functionality, the best startup business accounts provide features that actively support business development and growth. Fondy excels in this area by offering tools that help startups operate more efficiently and make better financial decisions.

Real-time analytics and reporting capabilities help founders monitor key financial metrics like burn rate, runway calculations, and departmental spending patterns. These insights are crucial for startups that need to demonstrate financial discipline to investors or make rapid strategic adjustments based on market conditions.

Automated financial workflows reduce administrative overhead, allowing startup teams to focus on product development and customer acquisition rather than manual financial management. Integration with accounting software, expense management tools, and business applications creates seamless operational processes that scale with the business.

The platform’s collaborative features support distributed teams and growing organisations. Multiple users can access different aspects of the account with appropriate permissions, enabling delegation without compromising security or control.

For startups preparing for funding rounds, Fondy’s comprehensive transaction history and financial reporting capabilities simplify due diligence processes and demonstrate operational sophistication to potential investors.

International expansion made simple

UK startups increasingly target global markets from inception, whether through digital products, international partnerships, or overseas expansion. Traditional banking makes international operations complex and expensive, but Fondy simplifies cross-border business significantly.

The platform’s multi-currency capabilities allow startups to hold balances in major currencies, reducing conversion costs and improving cash flow management. Local bank details in different regions enable startups to appear local to international customers, improving payment success rates and reducing transaction costs.

For startups with complex international requirements, Fondy provides additional services like forward contracts to hedge currency risk and mass payment capabilities for international payroll or supplier management. These features are typically available only to larger enterprises but are accessible to startups through Fondy’s platform. To explore which providers offer the best business account for international payments, including detailed comparisons and use cases, check out this comprehensive guide.

The transparent international pricing helps startups budget accurately for global operations, avoiding the hidden costs that often surprise businesses using traditional banking for international transactions.

Integration ecosystem for operational efficiency

Modern startups operate with diverse software ecosystems including accounting platforms, CRM systems, e-commerce solutions, and custom applications. The ability to integrate banking operations with these tools is crucial for operational efficiency and automated workflows.

Fondy’s API-first architecture and integration capabilities connect seamlessly with popular business tools, creating automated financial processes that reduce manual work and improve accuracy. Whether synchronising transactions with accounting software, automating payment processing for e-commerce, or connecting with custom business applications, Fondy’s technical infrastructure supports sophisticated integrations.

This integration capability becomes increasingly valuable as startups grow and their operational complexity increases. Rather than managing multiple disconnected systems, teams can work within unified workflows that automatically handle financial aspects of their business processes.

The platform’s webhook capabilities and real-time data access also enable startups to build custom solutions and automated workflows that match their specific business requirements, providing flexibility that rigid banking systems cannot offer.

Future-proofing your startup’s financial infrastructure

Choosing a banking partner is a strategic decision that impacts startup operations for years. The right choice provides a foundation for growth, while the wrong choice can create bottlenecks, additional costs, and operational friction that slow development.

Fondy’s approach to startup banking recognises that today’s two-person venture may become tomorrow’s hundred-employee scale-up. The platform’s architecture and feature set are designed to grow with startups, providing continuity and avoiding the disruption of changing banking systems as businesses evolve.

This future-proofing extends to international expansion, regulatory compliance, and technical requirements. As startups grow into new markets, handle larger transaction volumes, or integrate with more sophisticated business systems, Fondy’s infrastructure can accommodate these changes without requiring operational disruption.

The platform’s commitment to innovation also means that new features and capabilities are regularly added, ensuring that startup banking infrastructure continues to evolve with business needs and market requirements.

Making the right choice for your startup

Selecting the optimal startup business account requires careful consideration of your specific requirements, growth plans, and operational needs. While basic banking functionality is essential, the features that will truly impact your startup’s success are those that align with your business model and growth trajectory.

For startups prioritising simplicity and cost control, basic accounts with transparent pricing and essential features may be sufficient initially. However, for ventures with growth ambitions, international aspirations, or complex operational requirements, investing in more sophisticated banking infrastructure from the beginning can prevent costly migrations and operational disruptions later.

Fondy’s combination of flexibility, scalability, and comprehensive features makes it particularly well-suited for startups that want to establish solid financial foundations while maintaining the agility to adapt as their business evolves. The platform’s integrated approach to banking and payments, transparent pricing, and growth-oriented features address the specific challenges that UK startups face in today’s competitive environment.

Whether you’re in the early stages of validating your business model or preparing for rapid scaling, the right banking partner can significantly impact your startup’s trajectory. By carefully evaluating your requirements and choosing a provider that aligns with your growth plans, you can establish financial infrastructure that supports rather than constrains your entrepreneurial ambitions.