If there’s a topic we’ve missed, let us know, and we will be happy to dive into it.

- The best international business accounts for cross-border payments

- Setting up business accounts: how Fondy makes it simple

- Startup business accounts: how to choose the best option for your UK business

- Compare business accounts in the UK: features, fees, and benefits explained

- Best small business accounts UK: pick the right one with basic or extra features

- Top 10 business accounts in the UK and why Fondy is the best choice

- Best business accounts in the UK for limited companies or sole traders: compare with banks and open online

- How to open business accounts, set up and create sub-accounts & start making global payments with Fondy

Setting up business accounts: how Fondy makes it simple

Introduction

Traditional banking often feels like navigating a maze when you’re trying to set up business accounts. Between lengthy applications, multiple appointments, and weeks of waiting, many companies find themselves stuck before they can even start accepting payments. Fondy transforms this experience by offering a straightforward online platform where setting up a business account takes minutes, not weeks.

The shift toward digital banking has revolutionized how companies manage their finances. Yet many banks still cling to outdated processes that slow down business growth. When you need to open an account quickly to seize new opportunities, traditional banking timelines simply don’t work. That’s where Fondy steps in, providing businesses with instant access to professional banking services without the usual complications.

Why modern businesses need streamlined account setup

Today’s companies operate in a fast-moving environment where opportunities can disappear while you’re still filling out paperwork. Whether you’re launching a startup or expanding an established company, the ability to set up banking infrastructure quickly directly impacts your success. Online business accounts have become essential tools for companies that need to move fast and adapt to changing market conditions.

The complexity of international business adds another layer of challenge. Companies working with clients abroad often discover that their local bank account creates barriers rather than connections. Currency conversions, international wire fees, and processing delays can damage client relationships and eat into profits. A properly configured business account should enhance your operations, not complicate them.

Many entrepreneurs waste valuable time trying to work around banking limitations instead of focusing on their core business. When setting up accounts requires multiple visits to physical branches and stacks of documentation, it diverts attention from product development, customer service, and growth strategies. Modern businesses need banking partners that understand the value of time and simplicity.

The Fondy approach to simple business account creation

Fondy has reimagined what opening a business account should feel like. Instead of complex application forms and unclear requirements, the platform guides you through each step with clear instructions and immediate feedback. Within minutes of starting the process, your company can have a fully functional account ready to receive payments from customers worldwide.

The online application process eliminates traditional banking frustrations. You won’t need to schedule appointments, wait in queues, or explain your business model to multiple bank representatives. Everything happens digitally, with intelligent systems that verify your information quickly and securely. This streamlined approach means you can set up your account outside of banking hours, from any location with internet access.

What makes Fondy particularly effective is its understanding of diverse business needs. Rather than forcing every company into the same rigid account structure, the platform offers flexibility from the start. During setup, you choose between account types based on your actual requirements, not arbitrary bank categories. This customization ensures that your banking setup matches your business model from day one.

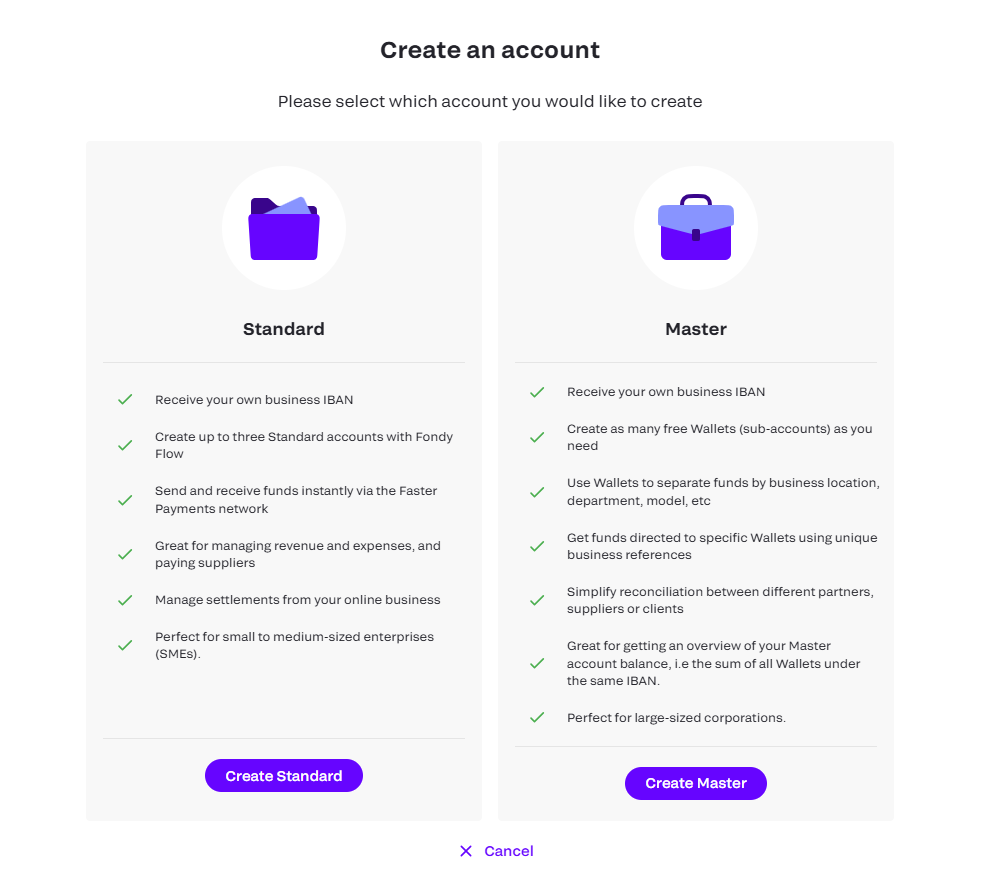

Business account options designed for real businesses

Not all companies operate the same way, so why should their banking? Fondy recognizes this by offering distinct account structures that match different business models. Small businesses benefit from standard accounts that provide essential features without unnecessary complexity. These accounts give you dedicated IBANs and multi-currency capabilities while keeping management simple and costs predictable.

Larger organizations or those with complex operations can opt for master accounts that support unlimited sub-wallets. This structure proves invaluable for:

- Companies managing multiple projects or departments

- Businesses operating in several markets

- Organizations that need clear financial separation

- Firms handling client funds or operating marketplaces

The beauty of this system lies in its scalability. You can start with a basic setup and expand as your business grows, without having to open entirely new accounts or deal with migration headaches. Each wallet maintains its own transaction history while contributing to your overall account balance, providing both granular control and comprehensive oversight.

Features that simplify daily operations

Once your account is set up, Fondy continues to make business banking straightforward. The platform’s interface presents complex financial information in an accessible format, allowing you to understand your company’s financial position at a glance. Transaction histories, balance summaries, and payment statuses update in real-time, eliminating the guesswork that often accompanies traditional banking.

Making payments becomes as simple as sending an email. The system remembers your regular counterparties, reducing repetitive data entry. When you need to pay a new supplier or receive funds from a new client, adding their details takes moments. The platform handles the technical aspects of international transfers automatically, so you don’t need to worry about SWIFT codes or intermediary banks.

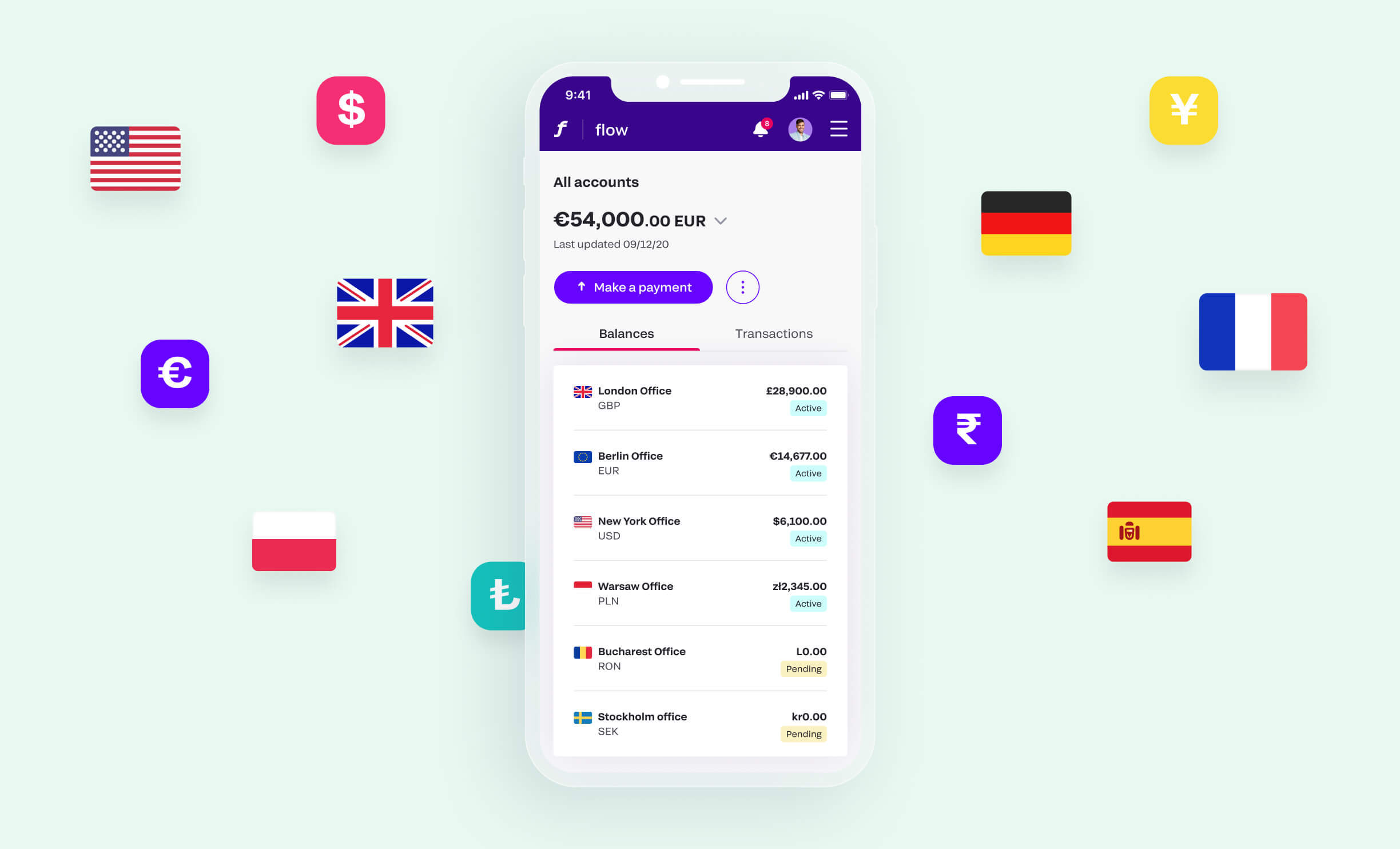

For businesses dealing with multiple currencies, Fondy eliminates the usual headaches. Your account can hold and transact in various currencies without requiring separate accounts for each. This flexibility proves especially valuable for online businesses serving international markets, as you can accept payments in your customers’ preferred currencies and pay suppliers in theirs.

Security without complexity

Business owners often worry that simple banking means compromised security. Fondy proves this is a false choice by implementing robust protection measures that work invisibly in the background. Advanced monitoring systems watch for unusual activity patterns, while strong encryption protects your data during every interaction with the platform.

The security measures extend beyond technology. Fondy’s verification processes ensure that only authorized individuals can access your company accounts, but these checks happen quickly during initial setup rather than slowing down daily operations. Multi-factor authentication adds an extra layer of protection without making routine tasks cumbersome.

Regular security updates happen automatically, keeping your account protected against emerging threats. Unlike traditional banks that might require you to update passwords or security questions periodically through complicated processes, Fondy handles security maintenance seamlessly. Your focus stays on running your business while professional security teams ensure your funds remain safe.

Getting started with confidence

Taking the first step toward better business banking doesn’t require extensive preparation. Companies typically complete the entire Fondy account setup in under 30 minutes, including verification. The process begins with basic company information and progresses logically through each requirement, with helpful prompts ensuring you provide everything needed for quick approval.

The platform’s support team stands ready to assist if questions arise during setup. Unlike traditional banks where support might mean lengthy hold times and transferred calls, Fondy provides direct access to knowledgeable specialists who understand both the platform and international business needs. This support continues after account creation, helping you optimize your setup as your business evolves.

Many business owners discover capabilities they didn’t know they needed during the setup process. The platform’s design introduces features naturally, showing how tools like sub-wallets or multi-currency management could benefit your specific situation. This educational approach ensures you’re not just opening an account but building a financial infrastructure that supports long-term growth.

Beyond banking: comprehensive business solutions

Transparent pricing

Fondy believes in straightforward pricing without hidden surprises. Unlike traditional banks that bury fees in complex documentation, every cost associated with your business account is clearly displayed upfront. Monthly maintenance fees, transaction charges, and currency conversion rates are all transparent, allowing you to budget accurately and avoid unexpected expenses. This honest approach to pricing helps businesses of all sizes plan their finances effectively while building trust through transparency.

Payment gateway integration

Your Fondy business account seamlessly connects with the company’s powerful payment gateway solutions. This integration means you can accept online payments directly into your business account without dealing with third-party processors or complicated reconciliation. The payment gateway supports multiple payment methods, currencies, and security protocols, giving your customers a smooth checkout experience while ensuring funds flow directly to your account with full transaction visibility.

Multi-currency capabilities

Operating internationally no longer means juggling multiple bank accounts across different countries. Fondy’s multi-currency features let you hold, receive, and send payments in various currencies from a single account. Real-time exchange rates and low conversion fees make international transactions cost-effective, while automated currency management tools help protect against exchange rate fluctuations. This comprehensive approach simplifies international business operations significantly.

API access for automation

Modern businesses rely on automation to scale efficiently, and Fondy provides robust API access to support your technical needs. Whether you’re building custom payment flows, automating reconciliation, or integrating banking data with your business systems, the well-documented APIs make development straightforward. This technical capability transforms your business account from a simple banking tool into a powerful component of your technology stack.

Dedicated support team

Every Fondy business account comes with access to specialized support professionals who understand both the platform and international business challenges. Unlike generic bank support that often lacks context, Fondy’s team provides knowledgeable assistance tailored to your specific needs. Whether you’re setting up complex payment flows or troubleshooting integration issues, expert help is always available through multiple channels including chat, email, and phone.

Scalable infrastructure

As your business grows, your banking needs evolve. Fondy’s infrastructure scales seamlessly from startup to enterprise, ensuring you never outgrow your banking solution. Advanced features unlock as needed, additional accounts and wallets can be created instantly, and transaction limits adjust to match your business volume. This scalability means you can focus on growth without worrying about banking limitations or forced migrations to new providers.

Conclusion

Setting up business accounts shouldn’t be a barrier to growth. Fondy has stripped away the complexity that traditionally surrounds business banking, creating a platform where companies can establish professional financial infrastructure in minutes rather than weeks. By focusing on what businesses actually need and eliminating what they don’t, Fondy delivers a banking experience that enhances rather than hinders operations.

The combination of simple setup, flexible account structures, and powerful features makes Fondy an ideal choice for businesses ready to move beyond traditional banking limitations. Whether you’re launching your first venture or expanding an established company internationally, the platform provides tools that scale with your ambitions while remaining refreshingly easy to use.