Use cases

Payments features

Get instant IBAN accounts for your business

IBAN accounts: open online & start accepting business payments immediately

Transform how your business handles international transactions with dedicated IBAN accounts. Get EUR, GBP or USD IBAN account numbers alongside UK details, enabling seamless cross-border operations from day one.

Why modern businesses need dedicated IBAN accounts

Running a business across borders requires more than basic banking. IBAN accounts provide the international connectivity that domestic-only accounts simply cannot match. While traditional banks treat international capabilities as an afterthought, Fondy makes them central to your financial operations.

Many companies struggle with receiving payments from European clients or managing euro transactions efficiently. Standard UK accounts often result in rejected transfers, conversion delays, and confused customers who expect proper IBAN details. These friction points damage professional relationships and slow business growth.

Set up your IBAN business account in three steps

Enter your business information online

Upload required documents digitally

Receive your unique IBAN instantly

Start accepting international payments today with your new online IBAN account

Unlike traditional banking where international features require separate applications and extended waiting periods, Fondy provides full IBAN functionality from the moment your account activates.

IBAN accounts designed for international operations

Every business IBAN account includes complete international banking details that work seamlessly across European payment networks

Your business gains immediate access to the SEPA payment zone, enabling fast and affordable euro or pound transfers throughout Europe & UK. This integration happens automatically – no special requests or additional fees required.

Essential features include:

- Dedicated IBAN numbers for each currency account

- Direct access to SEPA instant payments

- Local payment details for multiple regions

- Automatic currency detection and routing

These capabilities transform complex international transactions into routine operations, removing barriers between your business and global opportunities.

IBAN accounts without borders

Operating in euros or pounds becomes natural when your business account includes proper IBAN functionality. Rather than forcing currency conversions through intermediary banks, your IBAN account receives funds directly, preserving value and speeding settlement times.

European or British clients and partners expect to pay using familiar IBAN formats. Providing these details builds trust and professionalism while reducing payment failures. Your euro or pound transactions process as smoothly as domestic ones, eliminating the “foreign account” stigma that limits many UK businesses.

How instant IBAN accounts accelerate business growth

Speed matters in business, especially when establishing new revenue streams or entering fresh markets. Instant IBAN accounts remove the traditional delays associated with international banking setup, letting you respond to opportunities immediately.

Consider these common scenarios:

- Winning a European or British contract that requires immediate invoicing capabilities

- Launching an online service that needs multi-currency payment acceptance

- Establishing supplier relationships that prefer SEPA transfers

- Creating dedicated accounts for different market segments

With Fondy, each situation resolves instantly through your dashboard rather than requiring weeks of bank correspondence and documentation.

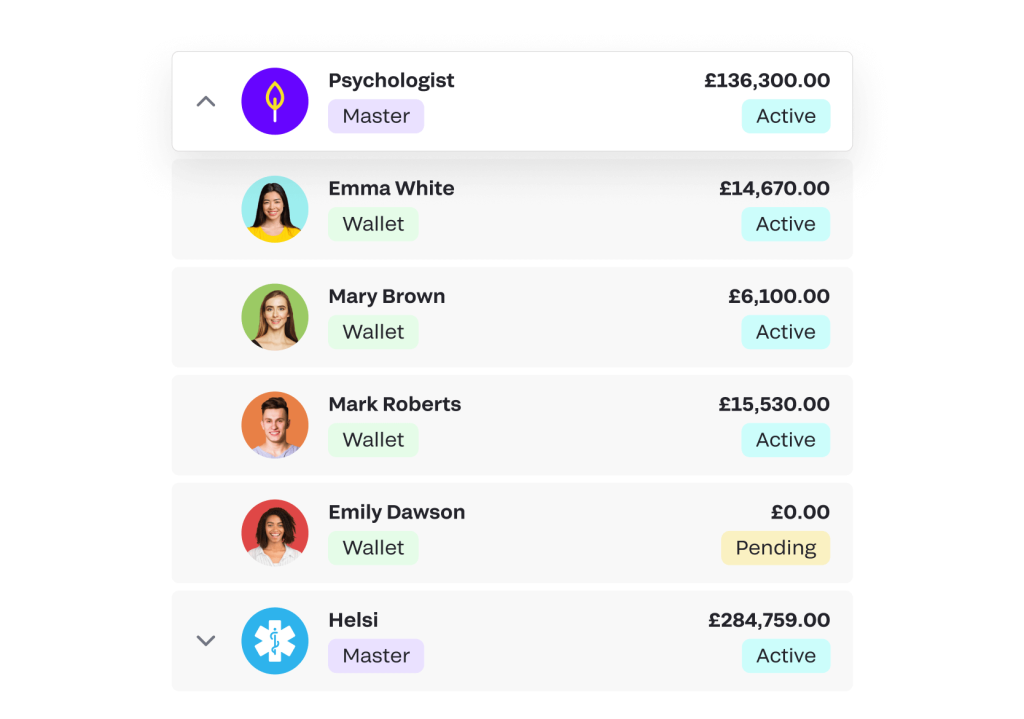

Create multiple IBAN accounts for strategic advantages

Smart businesses use multiple IBAN accounts to optimize operations and enhance financial control

Opening additional business accounts takes seconds, not appointments. Each new account receives its own IBAN, allowing precise transaction routing and simplified reconciliation.

Strategic uses include:

- Separate IBANs for different product lines or services

- Dedicated accounts for specific geographic markets

- Project-based IBANs for cleaner accounting

- Department-specific accounts with controlled access

This flexibility extends beyond simple organization – it enables sophisticated financial structures previously available only to enterprise clients of traditional banks.

Online IBAN accounts built for digital business

Physical banking infrastructure creates unnecessary friction for digital businesses. Online IBAN accounts eliminate these constraints, providing always-available access and real-time functionality that matches how modern companies operate.

Digital-first design means no branch dependencies, no paper forms, and no geographic limitations. Your business gains banking capabilities that work anywhere, anytime, through secure online access. This approach particularly benefits companies with remote teams, international clients, or digital business models.

Superior functionality compared to traditional IBAN services

Standard bank IBAN accounts often feel like afterthoughts – basic functionality bolted onto domestic-focused systems

Fondy’s approach starts with international capability as the foundation, building comprehensive features around global business needs.

Notable differences include:

- Immediate IBAN activation upon account opening

- Real-time balance updates across all currencies

- Integrated currency exchange at wholesale rates

- API access for automated reconciliation

- Multi-user permissions with activity tracking

These enhanced capabilities come standard, not as expensive add-ons or enterprise-only features.

Real businesses in the UK & EU achieving real results

Companies across industries rely on Fondy IBAN accounts to power their international operations. From freelancers receiving client payments to scale-ups managing multi-million euro or pound transactions, the flexibility scales with business needs.

Digital marketplaces and online sellers

E-commerce businesses operating internationally use IBAN accounts to streamline cross-border transactions. Dedicated euro, pound or dollar IBAN accounts enable direct payments from international customers without conversion delays.

Many establish separate IBANs for different marketplaces, making reconciliation straightforward when selling through multiple platforms. The instant IBAN setup proves invaluable during peak seasons when businesses need additional accounts quickly for handling increased transaction volumes.

Currency-specific IBANs also help track true profitability by market, eliminating confusion caused by constant exchange rate fluctuations.

Consulting firms and remote agencies

Professional services working with international clients depend on proper IBAN infrastructure for smooth operations. IBAN accounts allow invoicing European clients in their preferred currency, increasing payment success rates significantly.

Many agencies create project-specific IBANs to maintain clear financial boundaries between client engagements. This approach particularly benefits firms managing retainers or milestone payments across different currencies.

The ability to provide local IBAN details to clients in various countries enhances professionalism and reduces payment friction.

Tech startups and expanding businesses

Fast-growing companies need banking that matches their pace, especially when scaling internationally:

- Instant IBAN accounts for entering new European markets

- Multiple currency IBANs without lengthy bank applications

- Seamless integration with payment processors via IBAN infrastructure

- Professional banking details that build trust with international partners

These capabilities enable startups to pursue global opportunities without traditional banking delays that often handicap early-stage growth.

Transparent pricing for IBAN business accounts

- IBAN accounts from £10/month

- No setup or IBAN activation fees

- Competitive SEPA transfer rates

- Volume-based pricing discounts

- Clear fee structure without surprises

Open your IBAN account today

Getting an IBAN account online with Fondy requires just minutes of setup for lifetime of improved international banking. Experience banking designed for businesses that refuse to let borders limit their potential

Join the growing community of businesses that chose Fondy for their IBAN account needs. Simple setup, powerful features, and genuine support for your international ambitions

Questions about IBAN accounts or international features? Our team understands cross-border business and stands ready to help

Gateway

- Go borderless and accept payments from anywhere, anytime and anyhow

- Enable your customers to pay how they want wherever they are

- Enjoy full transparency with cost-effective pricing and zero hidden costs

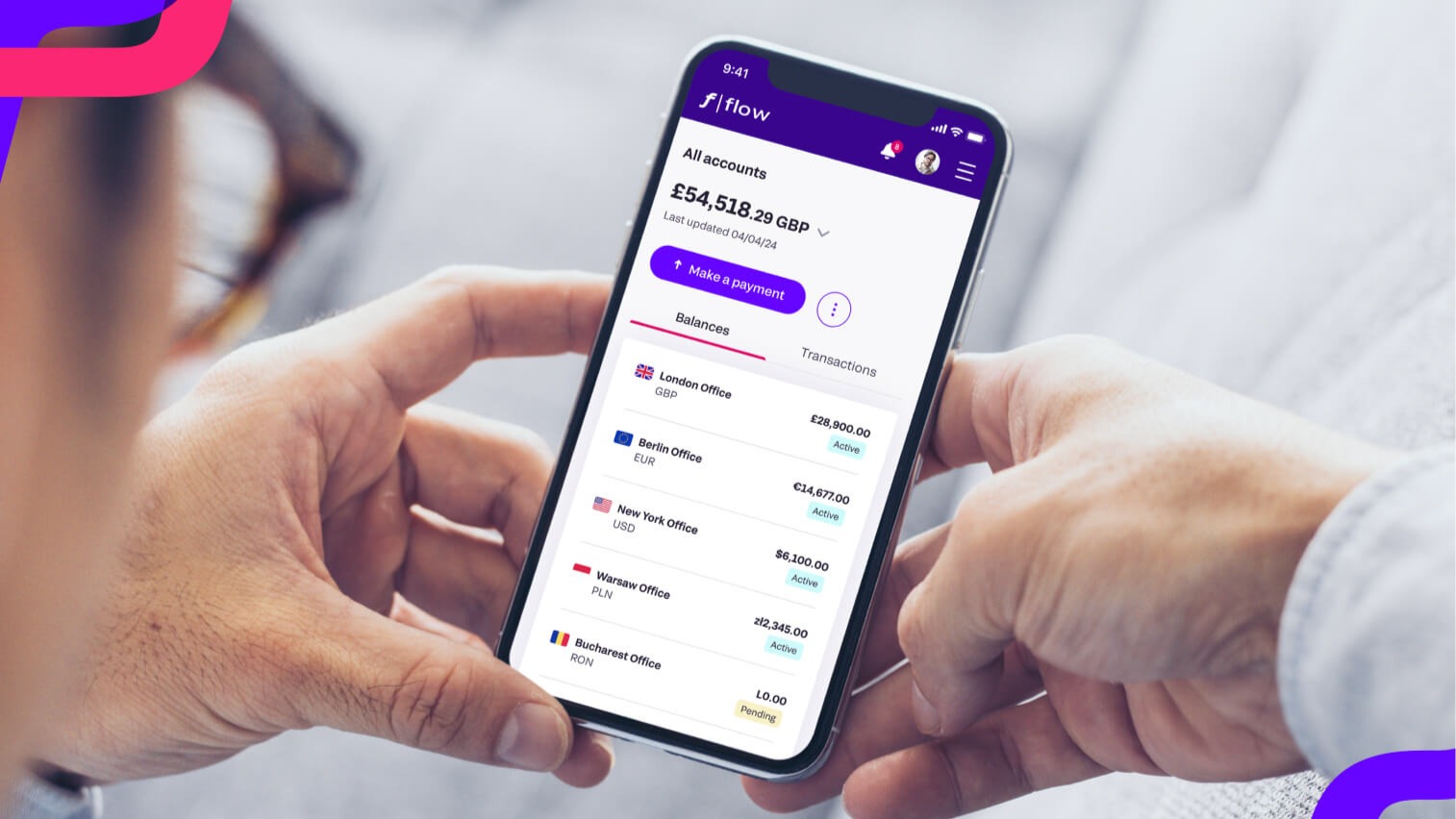

Flow

- Access faster settlements with multicurrency IBAN accounts

- Enjoy multiple benefits and features including recurring payments and payouts

- Manage all the movement of funds from one convenient platform without a third party

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.